|

As interest rates continue to rise, the housing market is certainly cooling off compared to last year. While these high interest rates are turning off many buyers, it’s actually an ideal time to purchase real estate. There’s more inventory available now than there has been at any point in the last decade, prices are dropping, and buyers now have the upper hand when it comes to negotiating any contract terms. However, if you don’t have ample cash on hand you may still be concerned about the affordability of purchasing a home. While the novice buyer is intimidated by the current market, you can actually take advantage of this incredible buyer’s market with a variety of creative purchasing strategies. BuyDownsEvery lender is shouting from the mountains right now about buydowns. The ability to buy down your interest rate is nothing new, you could always pay extra money upfront to buy down your interest rate. However, now that sellers are getting desperate, it’s more and more common to negotiate for the seller to incur the expense of lowering the interest rate. This seller expense comes in the form of a monetary concession to the buyer. You can use this concession to purchase a standard rate buydown for the life of the loan or what lenders call a 2-1 buydown. A 2-1 buydown allows the borrower to reduce the interest rate by two whole points for the first year of the loan and one point for the second year of the loan. In year three, the interest rate returns to the original rate. You can even couple this strategy with a standard buydown. For example, if your quoted interest rate is 7%, you could buy it down to 6.5% and then do a 2-1 buydown. In this scenario your interest rate would be 4.5% for the first year, 5.5% for the second year and 6.5% for the third year and each subsequent year. Lenders are even offering 3-2-1 buydowns now that allow you to lower the interest rate for the first three years of the loan. Depending on how long you want to live in the home, and how you foresee interest rates trending in the future you can choose the best option for you. It is worth noting that these 2-1 and 3-2-1 buydowns can only be used on primary and second home loans. Investment purchases are ineligible. Seller FinancingIf a seller owns their property outright, they can offer seller financing to prospective buyers. The seller dictates their qualifications for the buyer. They may require a certain credit score or want to see your bank statements, but ultimately the seller determines if they want to loan to you or not. In this scenario, everything from the interest rate to the length of the loan is negotiated between the buyer and the seller. This is a great opportunity to purchase a home with a much lower interest rate, and it’s also great for individuals who are self-employed or may not look as good on paper to a traditional lender. Savvy sellers are offering seller financing up front, but if you find a property where you know the seller doesn’t have a loan or their balance is relatively low, you can suggest seller financing too. Ultimately, the buyers and sellers goals will dictate the terms and conditions of the loan. You can expect to discuss the down payment, interest rate, length of the loan, first payment date, whether taxes and insurance will be escrowed or not, and penalties when negotiating seller financing terms. Wrap-Around LoansEven if the seller does not own their home outright, they may still be able to offer a form of seller financing. A wrap-around loan involves two home loans, the original loan between the seller and the bank and a new loan between the seller and the buyer. Imagine a seller purchased their home 4 years ago for $450,000 at an interest rate of 3%. They agree to sell their home for $600,000 and offer an interest rate of 5%. The seller will receive an initial payout at the time of closing in the form of the buyer's down payment and then will make money on the spread between the two loans each month. The exact terms of this arrangement will be spelled out in a promissory note, and the buyer and seller may choose to use a servicing company to simplify the relationship moving forward. Each month the buyer makes a payment to the servicing company. The servicing company pays the seller’s mortgage and then disburses the remaining funds to the seller. Wrap-around loans can be risky, but they can also be incredibly advantageous to both buyers and sellers. If you’re considering purchasing a home which involves a wrap-around loan, it’s prudent to hire an experienced real estate attorney to review the contract terms and legal documents. Loan AssumptionsWhile it is rare to see in residential home loans, there are some loans that are assumable. This means that you can assume the sellers current loan terms. If a seller financed their home in the past few years, this means you may be able to assume a loan with an interest rate in the low 3s! Sellers with an assumable loan should be clearly advertising this unique selling feature so keep an eye out for it in listing remarks. If you find a property you want to purchase with an assumable loan you most likely will still need to qualify with the original lender, but if you do you could get a loan with an interest rate that’s half of the current rate. When you assume the loan, it’s likely that there will be a substantial difference between the remaining loan amount and the purchase price. This means you will have to bring a higher down payment to the table or consider a second loan for the difference. A second loan would need to be approved by the original lender. Sure, there’s lots of technicalities when it comes to the feasibility of a loan assumption, but they offer a great opportunity too. You can get an incredibly low interest rate, and you’ll likely pay less in fees. While many banks charge loan assumption fees, they’re generally lower than an origination fee. Now is a great time to purchase real estate if you are creative with your financing strategy. It’s important to have an experienced professional to guide you through these various options, and help you identify the best ones for your unique situation. If you need an experienced REALTOR in Austin, Texas, contact us today.

2 Comments

Multiple offers are back in the Austin metro area. In fact, every home I have written an offer on so far this year has been in a multiple offer situation. So, how do you make your offer stand out to the seller? While price is oftentimes an important component when a seller is comparing multiple offers, it's not the only factor that affects which offer they ultimately choose. The strength of the offer, the terms that align best with the seller’s goals, and facts about you (the buyer) can also sway the seller’s decision. Aside from offering the seller a higher sales price, here are some ways you can put your best foot forward when competing in a multiple offer situation.

1. Find Out What Terms the Seller Wants Is the home vacant? If so, the sellers probably value a quick close. If it’s occupied, they may want a lease back or a closing date that’s far enough in the future that they have time to find a new home. Is there a sentimental chandelier that they want excluded on the contract? Does their Aunt Cheryl work at Best Title, and they really want to close with her? There are all sorts of things that a seller may prefer, but you’ll never know what these items are unless you ask. Find out what the seller prefers and do your best to craft your offer to match. 2. Shorten Contingencies Anytime where the buyer has a potential “out” in the contract is a contingency clause. By “out” I mean the buyer can back out of the contract, and get their earnest money back. There are a plethora of these in the Texas real estate contract, but some of the most common ones are: the option period, the number of days in the third party financing addendum, and the number of days to review the seller’s disclosure. If there are a lot of days in any one of these, i.e. 21 days to obtain full buyer pre-approval, it’s a risk for the seller. If they accept your offer, they could take it off the market for twenty days, and then you could inform them you weren’t unable to get financing approval and you would get your earnest money back. They’ll incur carrying costs and lose time on the market when qualified buyers could have been looking at their home. Minimize all of these contingencies in order to entice the seller to accept your offer. 3. Increase the Earnest Money or Option Money Increasing the earnest money is one of my favorite strategies to make an offer more appealing to sellers. In our market, most sellers expect to see a minimum of 1% earnest money. Consider depositing twice that or, if you can afford it, ten times that. The earnest money is held in escrow and ultimately applied to the sales price if you go through with it. If for some reason you don’t go through with the purchase, you will get this money back so long as you comply with the contract terms. Increasing the option money is a bit riskier. If you back out of the contract, you won’t get this money back. However, if you are fairly confident in the condition of the home, and you aren’t concerned about potentially losing it, increase the option money too. This will show your serious, and willing to put your money where your mouth is. If you go through with the purchase the option money is still applied to the sales price. 4. Pay for Typical Seller Expenses Traditionally, the owner's title policy was most often a seller expense in the Austin market. In recent years, this has not always been the case. In an effort to stand out amongst a pool of prospective buyers, more and more buyers are offering to pay for the owner’s title policy. Title policy rates are standard in the state and you should look up how much the policy will cost, before offering to pay for it. If the home is in an HOA, you can offer to pay for the resale certificate and HOA documents. If a survey is needed, offer to pay for this too. 5. Add a Letter? While the practice of writing a love letter to the sellers is not new, it has become controversial in recent years. These letters often allude to some aspects of the buyers' lives that could potentially put the sellers in a position of violating fair housing laws. Any letter that reveals one of the seven protected classes in the Fair Housing Act (race, color, religion, sex, disability, familial status, or national origin) could come back to harm you rather than help you. BUT, if you can avoid revealing any of these items about yourself, a letter to the sellers could help. I’ve heard of two cases recently in which the sellers chose an offer that was not the highest because they valued the fact that the buyers were going to be living in the home. Buying a home in the Austin metro area right now is tricky, but it’s not impossible. Having a pro by your side who knows all the strategies is key to your success. If you’re thinking about buying a home in the greater Austin area, contact me today. For many years I have heard horror stories from clients in regards to home owner’s associations. Most frequently, it comes from individuals who are simply perplexed by the excessive fees such associations can charge for merely delivering required paperwork. When you purchase a property that is located in a community with a home owner’s association (HOA) you need an official copy of the HOA documents and a resale certificate. These documents tell you the rules for the community, what the HOA fees cover, the HOA’s financials, and if the seller is delinquent on any HOA dues. Obviously, all of these things are important documents to look over if you are planning to purchase in the community. However, the fees associations demand for such documents are sometimes downright highway robbery.

Passed earlier this year, Senate Bill 1588 helps mitigate these concerns. Effective September 1st, HOAs are barred from charging inordinate fees for subdivision information statements and resale certificates. The bill placed a cap of $375 on the cost for subdivision information statements, and limited HOAs to charging a max of $75 for a resale certificate. This is a huge win, as I have seen HOAs charging thousands for these simple documents in the past. In addition to setting caps on the amount HOAs can charge for these resale documents, the legislation also included a few other safeguards aimed at protecting Texans. The bill does the following:

While these changes are certainly appreciated among industry professionals and consumers, the new legislation has one major pitfall. This legislation is wonderful for those residing in or purchasing a home in a community with a property owner’s association, but it does not protect anyone who lives in a condo association. With the increasing costs of land in central Texas, more and more builders are creating single family homes that live and act like a house, but are technically condos. These homeowners as well as traditional condo owners are still susceptible to exorbitant charges from condo associations. Do you have questions about buying or selling in an area with a home owner’s association in the greater Austin area? Contact me today. If you’re trying to purchase a home in the Austin area right now, you know it’s nuts out there. It makes finding toilet paper in April of 2020 look like a piece of cake. Securing that coveted PS5 last month - a walk in the park compared to buying an Austin home. Needless to say, it’s a challenge. I like challenges and if you do too, keep reading to learn how you can buy a home in Austin right now. Appease The Sellers Sellers in Austin obviously have the upper hand right now, so you need to do everything you can to make sure they like you and your offer. Find out what makes them tick, what terms they will find most favorable, and how you can win them over. This may involve some deep cyber stalking. After you learn that seller Mary has been pinning recipes for banana bread you could deliver your offer with a loaf of MeMa’s famous bread and even include her secret recipe. Or, you may just be able to ask what the seller's plan is in order to craft an offer that is most appealing to their needs and timeline. If the home is vacant, they probably want to close as soon as possible. However, if the sellers still live in their home, they may favor a closing date that is farther out or a lease back for a few months so they have enough time to find a new home. Sellers know that the market is in their favor right now, so many have already outlined the terms they find most favorable before their home even hits the MLS. Make sure to inquire as to what these are so that you can draft an offer to match. Pay Cash Cash offers always rank favorably among home sellers. When a purchaser is paying cash they can close quickly and there’s no potential for a contract falling apart due to issues with funding. In today’s omnipresent multiple offer situations, cash offers are becoming quite popular. If you can pay cash for a home, offer cash! You can always finance after you purchase the home. Don’t have a few hundred grand under your mattress? Just sell your first born child. Rob a bank or perhaps it’s time you start trying your luck with the Powerball. I hear there’s a jackpot of $970 million up for grabs tomorrow night. With that kind of payout you may be able to secure more than one house in the Austin market! All jokes aside, there are ways you can leverage yourself to place an all cash offer on a home. You may be able to get a secured loan that uses your investments in stocks as collateral or perhaps you have a wealthy relative that will make you a personal loan. If you need to sell your current home before you can buy a new one, there are various companies such as homeward who will put a cash offer on your new home for you. They then lease your new home back to you until you sell your old home. Once your old home sells, you can get a traditional mortgage to buy the home back from them at the same price they paid for it in cash. Of course, they do charge a fee for this service. Ultimately, mortgage rates are at an all time low, but everyone knows it. If you can find a way to offer cash up-front, you will have the upper hand. Waive Your Appraisal If you didn’t win the lottery or scourge up enough capital to be able to offer cash for your dream home, you best consider waiving that appraisal to some extent. Austin homes are selling so quickly right now, they are outpacing the market data. People are paying more for homes than they are worth based on the published comparable home sales data. This means your home may not appraise at the purchase price. Without an appraisal waiver addendum, the sale of the home is contingent upon the home appraising at the contract price. For sellers, this is a risk that the sale may not close. By adding the appraisal waiver addendum you are increasing the likelihood of your offer being accepted. But, if you couldn’t afford to pay cash for the house, you probably don’t want to waive the appraisal entirely. You may be able to do a partial waiver in that case. In this scenario, you would be agreeing up front that if the home appraises for less than the contract price you would be willing to bring additional cash to the table to make up the difference. And, you are capping the amount of cash you would bring making this a partial waiver. Let’s say you put in an offer on a home for $500,000, and you are planning to put 20% down ($100,000). You do have $200,000 in cash. If the home appraised for $400,000 and the lender required you to put 20% down they would only loan you $320,000. Technically, you could still afford to make up the difference. So you may want to do a partial waiver of your appraisal contingency. This ensures that if the home appraises for less than $400k you don’t have to move forward with the offer and your earnest money will be returned, but if the home appraises for between $400-$500k you will still be on the hook to comply with the contract and purchase the home. You should definitely consult with your mortgage lender before agreeing to waive your appraisal contingency. Forget about an Option Period When you put in an offer on a home in Austin you usually pay a few hundred dollars to the seller for an option period. The amount of option money you pay and the length of the option period are both negotiable. The option period allows you the time to do all necessary inspections and you can back out for any reason during the option period and get your earnest money back. I used to say the typical amount for an option period is a few hundred dollars for a week long option period. Today, that’s not going to cut it. Many buyers are foregoing their option period all together or offering thousands of dollars for a very short (1-2 day) option period. While I wouldn’t necessarily recommend giving up the opportunity for an option period all together, you may want to modify how you approach the option period. Make it as short as possible. If you can get in an inspector within 24 hours, you do not need a 7 day option period. If you are fairly confident there aren’t major issues with the home that would be deal-killers you may want to increase the amount for the option money. At the end of the day, option money is money that you may lose if you don’t go through with the deal. It’s kind of like gambling- only put in as much as you are comfortable possibly losing. Pay for Everything In normal times, the seller typically pays for the owner’s title policy in Texas. These are not normal times. Offer to pay for the title policy. If you need a new survey, pay for that too. A designer handbag for the seller- it could work. Were you thinking of asking for the seller to contribute towards your closing costs? Good luck with that. Perhaps you assumed getting the sellers to pay for a home warranty was standard practice- not anymore. These days, the buyer who pays for negotiable items is often the buyer who wins in a multiple-offer situation. All in all, don’t lose hope if you want to buy a home in Austin in the near future. While this slightly satirical commentary on the state of the current Austin market has many truths there are still ways to buy a home in Austin without throwing your entire life’s savings into it. Take a look at my other post, How to Win in a Multiple Offer Situation for less risky tips for crafting an appealing offer. Pay close attention to homes that have been on the market for a few weeks that others may have overlooked. You may not be able to buy your dream home right now, but that doesn’t mean you can’t make a home your dream home. Homes that look beautiful and show wonderfully will go quickly and with many of the terms outlined above. Some home sellers mistakenly choose a poor listing agent who decides to market their home with inferior quality cell phone photos that make me cringe. This does not mean the home doesn’t look great in person. Buying a home in Austin right now can be a challenge, but I know you are up for it! If you want help navigating this insane Austin market, contact me today. Purchasing a home is a big deal! It’s a huge move (literally and figuratively) for you and your family that will have significant consequences. If you don’t prepare and use caution in your home buying journey, you could end up in quite a pickle. That being said, if you recognize the following common mistakes, you will be primed for success when buying your Austin home. Not Being Financially PrepareD There’s no point in looking for homes until you know what you can afford. One of the biggest mistakes a home buyer can make is looking at homes before you have spoken with a lender. After all, how do you even know if you can afford to buy a home or what your budget for a home is. Unless you are paying cash, your first step in the home buying journey should always be to speak with a mortgage professional. Another common pitfall many prospective home buyers make is to only speak with one home lender. Do yourself a favor and don’t fall victim to this common mishap. When you speak with a number of different lenders, you increase your odds of finding the best rate and the best personality fit. If you need recommendations for Austin lenders, I’m happy to provide recommendations. Just make sure to compare lenders within a two week time period so that your credit only received one hard inquiry. Wanting it AlL Before you begin your Austin home search, think carefully about what you must have and what you want it a new home. Make sure to bring in anyone else who will have a say in the home purchase, and compare your lists. Once you are on the same page, it’s important to take a good long look at your list and really narrow down those must-have features. A common mistake I see among Austin home buyers is that they are looking for the perfect house. The perfect house may not exist! Although buying a home is often an emotional decision, it’s also a financial one and you may need to be flexible in your criteria. Caring More About Features Than LocatioN Although most Austin area home buyers I work with often have an idea of the location they would like to live in, they sometimes fail to recognize the importance of location over property attributes. Time and time again, I find myself re-iterating that you can change the carpet, you can paint the walls, you can add a double oven BUT you can’t change the home’s location or lot size. Think carefully about the neighborhood, the school district and the attributes of the lot itself.

Have questions about buying a home in the Austin Area? Contact me today. Your monthly housing payment consists of more than just your mortgage payment. When you are looking at purchasing a new home, it’s important to consider everything that goes into your total payment so that you can identify homes that fit in your budget. Although looking at a home’s price is a good starting point, two homes that are the same price can have very different monthly payment amounts. Principal and InteresT The majority of your monthly housing payment will likely consist of principal and interest payments for your home loan. This will vary based on the amount you put down on the purchase of the home, and the terms of the loan. However; if you putting 20% down or less on a 30 year conventional loan, the principal and interest portion will be the bulk of your payment. Initially, you will pay more in interest than you are paying down on principal. Over time, you will gradually see more of this total payment going towards principal than interest. Mortgage InsurancE If you put less than 20% down on the purchase of your home you will also have some form of mortgage insurance in your total monthly housing payment. Private Mortgage Insurance (PMI) is required for conventional loans with less than 20% down and Mortgage Insurance Premium (MIP) is an insurance policy required on Federal Housing Authority (FHA) loans. Both PMI and MIP are protection for the lender in the event of default. A borrower may request that PMI be removed when the loan to value ratio reaches 80% either through payments to the principal, appreciation of the home, or a combination of both. MIP also may be able to be removed, but it will vary based on the loan terms and could even require a re-finance. Home InsuranceIf you’re purchasing a home, you are going to want to insure it, and a lender will require that the property is insured. Insurance rates can vary by company, policy details, and the property. An older home will likely have a higher insurance rate. If there were many claims on the property over the years, the rate may be higher. The rate will also vary based on the location. The safety of a neighborhood and the likelihood of natural disasters is also going to influence your monthly home insurance rate. TaxesHere in Texas, it’s especially important to pay attention to property tax rates. After your principal and interest payment, this will likely be the second largest portion of your total monthly housing payment. Property tax rates in Central Texas can vary from under two percent to over four percent. On a $400,000 home with a two percent property tax rate, you will pay around $667 per month towards property taxes. For another $400,000 home with a four percent tax rate that amount doubles to $1,334 per month. It’s easy to see how even a small change in the property tax rate can have a significant impact in your monthly housing payment. Make sure to pay attention to property tax rates when looking for a new home that’s in your budget! Additional ConsiderationsAlthough they are not traditionally included in your monthly mortgage payment, Home Owner’s Association (HOA) fees are something that should be included when thinking about your monthly housing expenses. HOA fees for some Austin area homes exceed $1,000 per month! Even though these figures are not paid in conjunction with your monthly mortgage payment, they are factored in when determining loan eligibility. Other factors to consider include utility costs. An older home may have higher utility bills compared to a newer home that has more energy efficient upgrades. A home located in a Municipal Utility District (MUD) may have a higher tax rate because of that MUD payment. Homeowners in a Public Improvement District (PID) will have to pay a fee, usually annually, to cover the costs of the infrastructure. As you can see, your monthly hosing payment is made up of many different factors. It’s important to consider all of these items when looking for a home you can afford. Make sure to look into all of the details before you fall in love with your next home. If you have questions about the home buying process, or want a dedicated broker to help you navigate the Austin real estate market, contact me today.

There are quite a few equestrian friendly neighborhoods in the greater Austin area, and there are other properties that may not be located in a horse community, but are well suited for horses. Obviously, the most important factor to consider when looking for an equestrian property is if the deed restrictions permit horses. Once you ensure the property can legally have horses on it, you will want to make sure the property is suitable for horses too.

When looking for an equestrian property in the greater Austin area make sure to consider these factors:

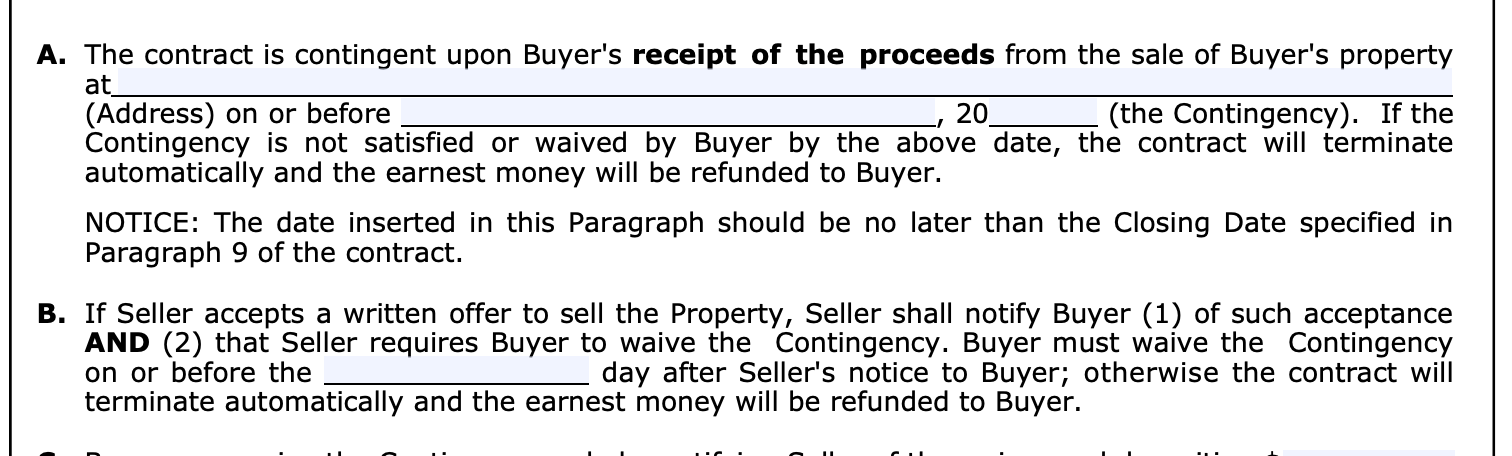

Austin Area Homes For Sale In Horse Friendly CommunitiesHorse Friendly Communities in Bee Cave: The Homestead Madrone Ranch Horse Friendly Communities in Spicewood: Rivercliff Ranch at Windemere Paleface Ranch Paleface Homesteads Granite Ridge Horse Friendly Communities in Driftwood: La Ventana Horse Friendly Communities in Dripping Springs: Polo Club at Rooster Springs Horse Friendly Communities in Southwest Austin: Bear Creek Estates Horse Friendly Communities in Hutto: Heritage on San Gabriel Horse Friendly Communities in Georgetown: Ranches of Sontera Horse Friendly Communities in Leander: Lone Mountain Ranch When a property is listed for sale in the MLS, the home can be listed under a variety of different statuses. Most commonly, you are looking at homes that are listed as active. However, sometimes you may see properties listed as active continent. An active contingent property is a property where the owners have accepted an offer on the property, but the buyers must sell another property before closing on the sale of the subject property. In Texas, there is a promulgated contingency form that outlines the terms of this agreement. The Addendum For Sale of Other Property by Buyer form specifies when the buyers must close on the sale of their current home and what will happen if the sellers receive another offer on the home. This form stipulates that if the seller receives another offer on the property they must notify the buyers of said offer. The form also specifies a certain number of days in which the buyers must either waive their contingency or the contract will terminate automatically. If the buyer elects to waive the contingency, the buyer is stating that even if they don’t sell the current home, they will still purchase the subject property. As a seller considering accepting an offer that is contingent, you should be sure to carefully read this contingency form. The date in which the buyers must sell their current home is important to review. If you are looking for a quick close, you want to make sure this date is not too far in the future. You will also want to ask questions to see how far along they are in the selling process. Do they have their current home on the market yet? If so, have your agent review the listing to make sure they are priced aggressively, and marketing appropriately. If the home is not even on the market yet, you will want to ask more questions to determine when they plan on listing the home for sale. You also want to make sure that the number of days required to respond when notice of another offer is received is not too long. In my opinion, three days is usually adequate. If the current buyers have too much time to respond, you may lose out on the second offer. If you are a buyer submitting an active contingent offer, you should also consider how the seller will feel about the contingency. By providing proof that your current home is actively being marketed for sale and is priced correctly, you can ease the seller’s apprehensions about accepting an offer that is contingent.

One more interesting caveat in the active contingent scenario is that if you receive a second offer that is higher than the first, you can’t simply accept it. In fact, the only way you can accept the second offer is if the original buyers decide not to waive the contingency and the first contract automatically terminates. In this event, the earnest money that the contingent buyers submitted would be refunded back to them, and you could proceed to accept the second offer. If you have any other questions about active contingent status in Texas or general real estate questions, I am always here to help. Feel free to give me a call or send me an email. Congratulations! You have finally found a house that you want to call home! Once you are officially under-contract (which means that you submitted an offer on a house, and the sellers have accepted the terms and signed the offer to acknowledge the acceptance), there are a few things you will need to do right away! First things first, if you are using a loan to purchase the home, make sure your lender has a copy of the executed contract. This will ensure that he or she gets the ball rolling on the funding side. Next, you will need to write two checks, the option money check and the earnest money check. The amounts for each of these checks will already be determined in the contract. You will want to make the option money check out to the sellers and the earnest money check out to the title company. You have three days to submit these checks. For the earnest money check, that means three business days since that check is going to the title company and they probably won’t be open over the weekend. For the option money check, that one must be delivered within three real days. This sounds pretty easy in theory, but in reality it can be a bit trickier to execute. What if you are out of state, and the contract is executed late on Friday? You may need to have the checks overnighted, or sometimes, you can wire the total amount for both checks to the title company and the title company will cut the option check out of the total wire. Aside from making sure your two checks get to the appropriate parties on time, you also will want to schedule your inspections. A home inspection is always a prudent choice. The inspector will go over all the various aspects of your home with a fine tooth comb, and point out any areas of concern. You may want additional inspections during the option period too. If the home is on a septic system, it’s a good idea to get a septic inspection. Likewise, if it has a pool you may want to get that inspected too. The option period is your time to do any and all necessary due-diligence on the property. If there is something unveiled that’s a deal breaker, you can back out of the contract without losing your earnest money. You may also consider scheduling some contractors during the option period. If you’re planning to remodel or make any structural changes to the home, you can get quotes and advice from qualified contractors during this time. If purchasing this home is contingent on being able to remove a wall, and the contractor reveals it will cost way more than you can afford, you can still back out of the contract during the option period. Before your option period ends, you have the opportunity to renegotiate. If there were serious issues revealed in the inspection, you can prepare an amendment to state that the seller will either fix these issues, or you can negotiate money off the sales price so that you can complete these repairs. This is not the time to ask for $5k off the sales price because you don’t like the color of the home. This amendment should only be used to address concerns that you were not aware of until the inspector pointed them out to you.

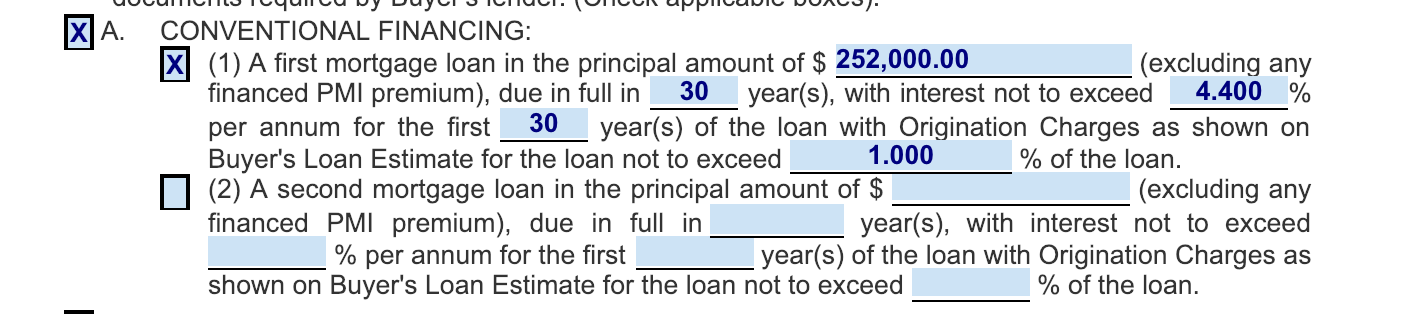

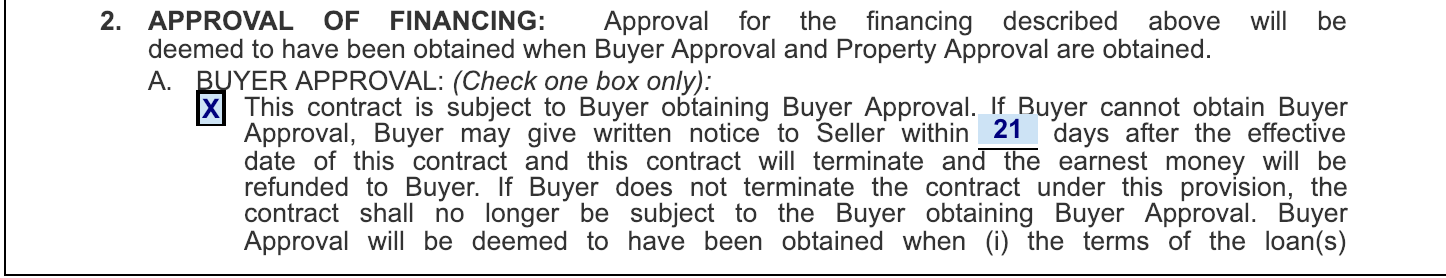

If there are concerns you would like addressed, you will present your proposed solution to the seller. If the seller agrees to fix the issues or give you money off the sales price, you will both sign an amendment to the contract clarifying this agreement in writing. If you cannot come to an agreement, you can either back out of the contract or proceed with the sale knowing that you are going to have to fix these issues at your own expense after closing. It’s important to schedule all of your inspections early in the option period to allow the time to review the findings and negotiate with the sellers if necessary. While you can still negotiate repairs after the option period, you have little leverage after the option period is over since you no longer have the ability to back out of the contract without losing your earnest money. Once, the option period is over, there will be little for you to worry about until the closing date. You may need to provide more documentation to your lender, and if the home doesn’t appraise that could be another opportunity to negotiate the sales price. If you have questions about the buying process in Texas, feel free to contact me today. I’d be honored to help guide you through the process of finding a house to call home. As we approach the high season in the land of real estate, more and more properties are experiencing multiple offer situations. When two or more parties have submitted an offer on the same piece of property, it becomes a multiple offer situation. This is often referred to as a bidding war. However, it’s not always the party with the highest offer price that wins. Many different variables affect the offer that ends up being selected by the seller. It’s important to understand these variables, so that you can craft the strongest offer. First, it’s important to understand what the seller wants. Has the seller already vacated the property? If so, they most-likely would appreciate a quick close. If they are still living in the home, you should inquire as to the seller’s ideal closing date, and craft your offer accordingly. One of the most common oversights I see in offers submitted in a multiple offer situation is in the third-party financing addendum. The third-party financing addendum is required with any offer that involves financing. The first oversight I see is in regards to the term of the loan. The addendum spells out the limits for the interest rate and the origination charges. It puts a maximum value on these terms. For example, say your lender has quoted you a 4.4% interest rate, and 1% origination charge. In the third part financing addendum, you enter these same figures. What if the interest rate changes, and now you can only obtain a loan with a 4.5% interest rate? You would have an out from the contract. This is good for the buyer, but the seller is looking for the buyer with the highest likelihood of purchasing their home. Would you still purchase the home if your interest rate went up to 4.5% or 4.6%? If so, you should make sure the third party financing addendum reflects the maximum interest rate and origination fee that you would pay. The third party financing addendum also specifies the amount of time, if any, needed for buyer approval. Oftentimes, I see “21 days” in this paragraph. That means that you, as the buyer, have 21 days to be fully pre-approved by the lender, and you have an out from the contract for 21 days after the execution date. This is a really long time! If you, as a buyer, are fully pre-approved, and the lender has had all of your personal financial documentation go through underwriting, you can enter a much lower number here! Try to make this number less than or equal to the number of days in your option period, and the offer will be much more enticing to the seller.

Increasing the amount of earnest money you will pay also strengthens the offer. The earnest money is held by the title company, and ultimately applied to the sales price. If you have the funds to do so, consider putting a larger amount here. If you back out for any reason, this money will be refunded to you. Similarly, consider the amount of money you will pay for the option period, and the number of days you will need for the option period. In contrast to the earnest money, the option money is not refundable. If you decide to back out of the purchase during the option period, you will not get this money back. However, if you are really serious about the home, and don’t think you will back out, consider increasing the amount of option money. You can, and should, make sure that if you do purchase the home, the option money is applied to the sales price. Additionally, consider how long you need for the option period. How long will it take for you to get an inspection done? The shorter the option period is, the more appealing the offer is in the eyes of the seller. Traditionally, in Texas, we see the seller paying for the owner’s title policy. If you want to make your offer super strong, consider paying for the title policy. Also, think carefully about any other concessions you may want to request. Asking for contributions to closing costs or home warranties negatively affects the seller’s bottom line. Crafting a personal letter to the sellers sometimes works. If you’re in a multiple-offer situation, you might as well give it a shot. Tell the seller why you want to purchase their home. Compliments, and a personal back story often go a long way. Sellers sometimes choose an offer not because it is the highest, but because they can envision you living in their home. Lastly, choose an agent who is experienced, professional, and knows how to write a clean offer. As a listing agent, I have advised my client to consider accepting an offer that was lower than the highest offer, simply because the offer was well-written. I can tell a lot about an agent from the way the offer is presented. If there are mistakes and oversights in the offer itself it makes me doubt their ability to do their best to get the offer to the closing table. If you’re looking for an agent in the Austin area, contact me today. |

BLOGSharing Austin real estate updates, home owner tips, & more. Archives

February 2024

Categories

All

|