|

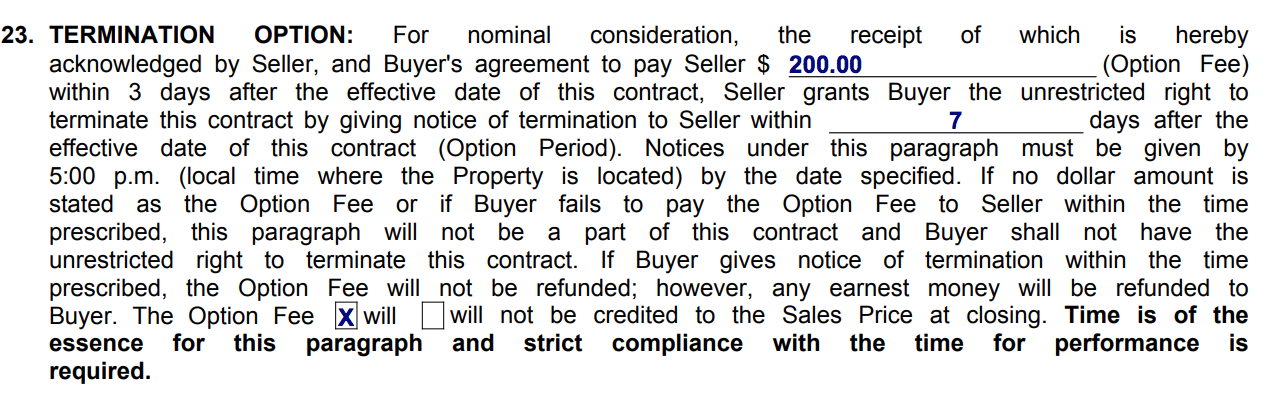

The Austin real estate market can be quite competitive. It’s not uncommon for lower priced homes to have more than one offer within the first day of being listed for sale. As a buyer, there are a variety of strategies you can implement to put your best foot forward in this situation. First, it’s important to find out what is important to the seller. Are they looking for a quick close? Will they appreciate your emotional attachment to the home? Or, do they simply want to accept the offer that will net them the most money? What you find out about the seller’s motivations will help you craft the most competitive offer. Regardless, of their preferences, a significant amount of earnest money will illustrate serious interest in the home. For example, if you traditionally would put $3,000 in earnest money on a $300,000 home. You could instead offer $5,000 in earnest money. This money will be applied to the sales price if your offer is accepted and you move forward with the purchase, or will be returned to you if you back out during the option period. That brings me to my second point, the option period. The option period is a specific amount of days you pay for to do all necessary due-diligence on the home. This is typically when the inspection is performed, and if you decide to back out during the option period, your earnest money is returned to you and you just lose the option money. Shortening the number of days in your option period strengthens your offer. Additionally, increasing the amount of option money shows you have more skin in the game. Using the same example as before, consider offering $300 option money for a 5 day option period verse $150 for a 10 day option period. Again, if you proceed with the purchase, this money will be applied to the sales price. Click here to learn more about option money vs earnest money. Traditionally, the seller pays for the owner’s title policy. Want to make your offer uber competitive? Offer to pay for the owner’s title policy. Similarly, consider taking on the survey expense if needed. Ultimately, multiple offers are a numbers game. Various items take away from the seller’s net proceeds such as: home warranty, survey, closing costs, and the title policy. Consider removing these from your offer, or come in with a higher purchase price to counteract them. Illustrating that you have the financial capacity to purchase the home is also critical. If you are submitting a cash over, make sure to send proof of funds. If you are using financing, sending a pre-approval letter is the minimum. A phone call or email from the lender directly to the listing agent is even better. In Texas, the third party financing addendum specifies the number of days required for buyer approval. The shorter the number of days, the more appealing your offer is to the seller. Furthermore, consider waving the appraisal contingency if you can. By stating upfront that you will pay the difference in cash between the appraised value and the offer price, you show the seller that you mean business. Combine these strategies with what you know about the seller to craft the strongest offer. If the home is vacant, they may value a quick close. Can you move your closing date up to be more competitive? Did you see a beautiful dog house in the back and recognize the sellers as animal lovers? Maybe a hand written note with a pic of Spot will help you win over the hearts of the seller.  If you’re interested in purchasing in the Austin area, don’t be frightened. This market is competitive, but with a strong agent by your side, you can get the home you deserve. Contact me today to get started.

0 Comments

Leave a Reply. |

BLOGSharing Austin real estate updates, home owner tips, & more. Archives

February 2024

Categories

All

|