|

Accessory dwelling units (ADUs) also referred to as secondary dwelling units, casitas, or granny flats are fully habitable homes that accompany a primary residence on a lot. In Austin, these have become quite popular as a result of the City of Austin loosening regulations on their construction. You can read all about the exact regulations in my earlier post, Navigating the Accessory Dwelling Unit Process in Austin. ADUs are a great opportunity for investors to maximize their rental rates on a buy and hold property, homeowners to earn supplemental income through an on-site rental property, and developers to purchase one property and then sell two units. For buy and hold investors, the ADU makes economic sense. As home prices soar in Austin, it’s become more challenging to find income producing properties with rental rates that justify the asking price. For example, a $300,000 home with a $2,000 market rent is an ok investment. If you put 20% down, your monthly payments will likely be less than the monthly rent you receive. However, the margins are close - adding in leasing expenses, repairs, and vacancy loss, -you may only be breaking even or losing money. Now, if this same property has a detached garage that you could convert to an ADU for $100,000 you have a much better investment. You could even do the rehab using a FHA 203k or Conventional Homestyle loan which combines the ADU project with the primary home purchase into a single mortgage loan. Homeowners can also utilize the FHA 203k or Conventional Homestyle Loan by coupling their accessory dwelling unit costs with a refi on their primary residence. The new accessory dwelling unit could be used for a family member to live in hence the term “granny flat”. Alternatively, a homeowner could utilize the ADU as a long term rental to offset mortgage payments. Developers are loving the ADU regulations in Austin. Most commonly you are seeing developers purchase a home or lot and then build two new units on the lot. The lot is not legally subdivided; rather, they do a condo regime in order to then sell both units separately. This practice is quite common in the following Austin zip codes: 78704, 78745, and 78702. Identifying properties with the ability to have two homes on one lot in Austin is somewhat challenging. There is no easy way to search for homes for sale with ADUs in the Austin Board of REALTORS’ MLS. Luckily, I’ve identified a few properties with ADU potential. These properties either already have an ADU, have an existing structure that could be converted to an ADU or are located on a lot with secondary dwelling unit potential.

5002 Balcones Dr. Austin, TX 78731 911 Payne Ave. Austin, TX 78757 11705 Pollyanna Ave. Austin, TX 78753 6302 Brookside Dr. Austin, TX 78723 4202 Bradwood Rd. Austin, TX 78722 2301 S 3rd St. Austin, TX 78704 200 Ainsworth St. Austin, TX 78745 1309 Green Forest Dr. Austin, TX 78745 1209 Austin Highlands Blvd. Austin, TX 78745 4506 S. 1st St. Austin, TX 78745 2407 Cecil Dr. Austin, TX 78744 4402 Hayride Ln. Austin, TX 78744 1526 FM 1105 Georgetown, TX 78626 3018 Ranch Road 1869 Liberty Hill, TX 78642 2317 N Shields Dr. Austin, TX 78727 8601 High Valley Rd. Austin, TX 78737 If you are looking for a property with ADU potential, contact me today. I can help simplify the process of finding the appropriate property for sale in Austin.

2 Comments

If you’re thinking about buying a lot in Austin, there are a few things you should consider. First, can you do what you want on this lot. Are there restrictions in regards to building, use, or activities that would prohibit you from doing what you want to on this piece of property? Second, you need to consider the physical qualities of the lot. Are the inherent characteristics of this piece of land in alignment with your goals for the property? Lastly, you need to consider the man made infrastructure associated with the property- utilities and roads. First, you want to consider what restrictions there are on the lot you are interested in purchasing. Restrictions can be imposed on a given lot for a number of different reasons; however, usually these are in place to control the appearance and quality of life of a community. Restrictions may minimal such as “no pig slaughtering facilities allowed” or they may be very specific such as “exterior of home must be constructed of limestone”. If you want to build a barnodominium on your lot, or park a tiny house on it for a few years you should definitely be paying close attention to the lot’s restrictions. So, how do you find the restrictions. Your first step should be to ask the listing agent/owner for a copy. They should be able to provide you a copy or you can ask a title company for a copy of the title commitment and associated Schedule B documents. Pay close attention to the Schedule B documents. These documents, sometimes referred to as the everything but documents, outline the areas the tile policy will not cover. Make note of any easements, these will also be shown on the survey, and make sure they will not prohibit you from doing anything you would like to do on the lot. Also, pay close attention to the building requirements. Some communities may mandate that you build on the lot within a certain time frame or have specific square footage minimums or maximums. Lastly, look out for mineral leases. If you don’t want the possibility of someone having the ability to come on your land and drill for oil at their will, make sure there is no mineral lease associated with the lot. The physical characteristics of a lot are important to consider when purchasing land in Austin as well. Google earth will definitely be your friend when doing preliminary research on a lot you are interested in purchasing. Check to see if it’s in the floodplain. Look at the property on a topographic map to make sure it’s not a small piece of level land with a sharp cliff that covers the rest of the lot. Look to see if there are large trees that would be in the way of your dream home site, or a creek bed that doesn’t conform with your vision. MapRight is another great tool for assessing a lot’s potential from the comfort of your computer. One of the most important considerations when deciding what lot to buy in Austin is in regards to utilities. You need to know what utilities the property currently has, and if it doesn’t have utilities you will need to determine how much it will cost to get these. Is your only option for water to drill a well? You should check with local well companies to see if it’s even possible for you to drill on your lot, and if you do, will your water be consistent? Ask about the depth of the well and anticipated gallon/minute rate. For power, you will want to find out if the power lines are already run to the property? Are they just at the street, and you will need to pay to have them brought to the home site? If so, find out how much that will cost. Additionally, consider the lot’s current accessibility to wastewater and gas if those are utilities you would like to have on your lot. Determine if your lot is easily accessible. Hopefully, your lot is located on a public road of some sort. Maybe it’s not, and your lot was just created when an owner decided to subdivide his property. Determine how much it’s going to cost to pave your driveway, and if you drive a brand new Mercedes, you may not want to purchase a lot on an unpaved road.

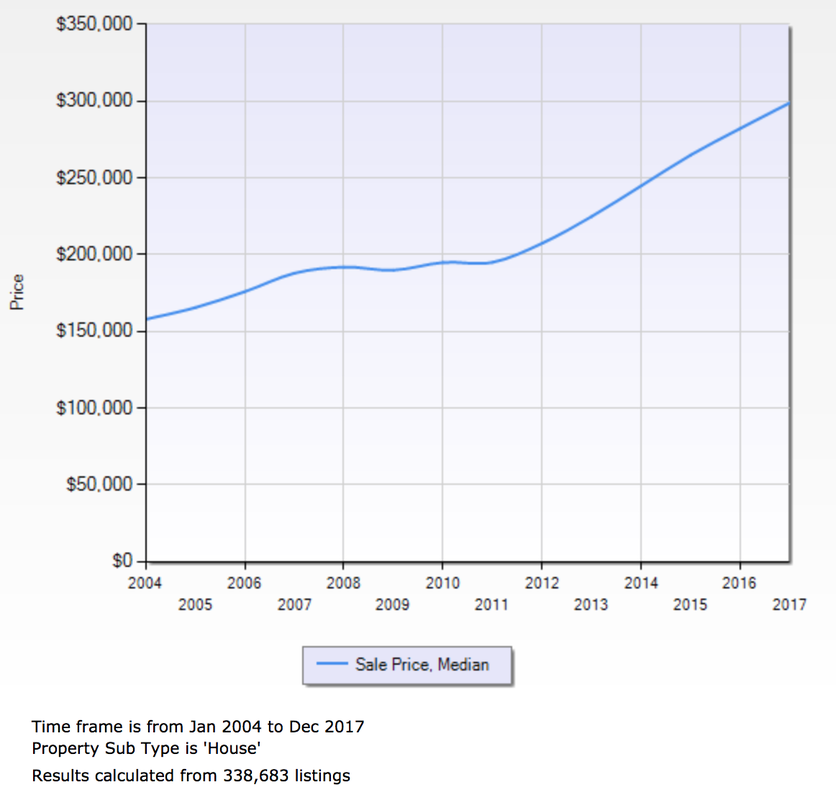

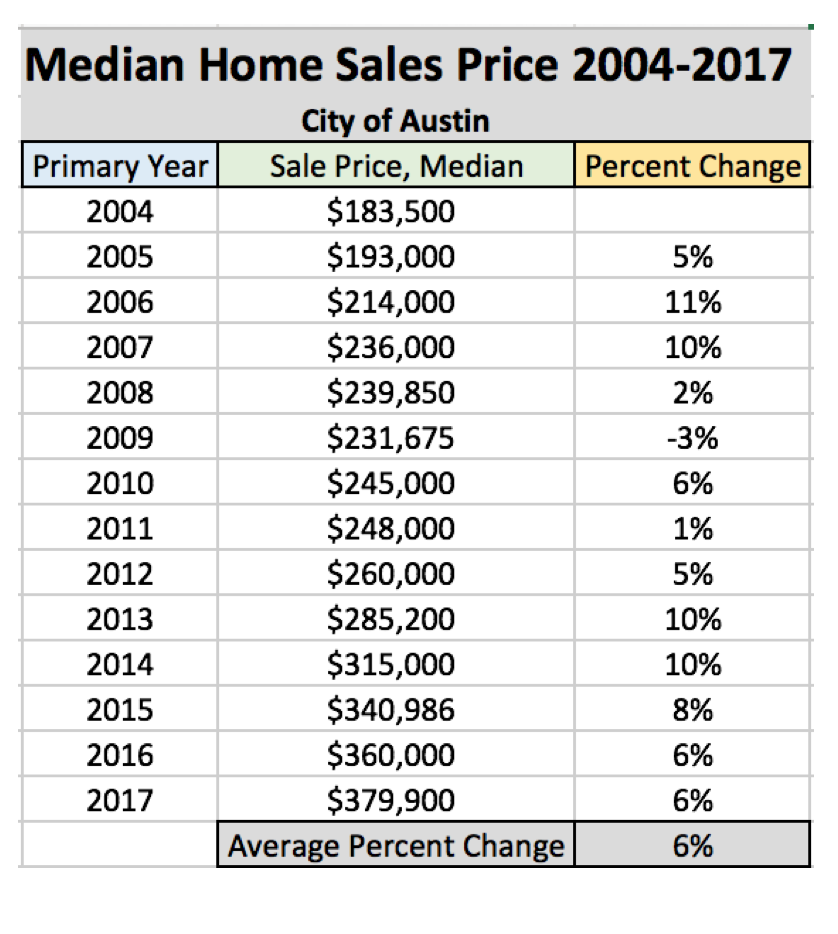

Buying a lot in Austin allows you flexibility. However, there are many items that will restrict the freedom you have to do what you want on your lot. Pay close attention to the restrictions, easements, and natural characteristics of a lot before you buy, and don’t forget to run the numbers. You may be able to get a great deal on an unimproved lot, but you could wind up paying a fortune on clearing and utility set-up. If you’re considering buying a lot in the Austin area, contact me today. I’m happy to walk you through the process. Click here, if you want to see current lots available in the Austin area. In 2004, the median home sales price in greater Austin for a single family home was $158,000. In comparison, the median home sales price in the greater Austin area in 2017 was $299,000. Overall, the median home sales price has increased almost every year in the past 14 years. In 2008-2009, the median sales price dropped 1.04%, and in 2010-2011, it remained the same at $195,000. This was during the largest housing market collapse in the US history. Austin was impacted very little in the grand scheme of things. On average, between 2004-2017 the median single family home sales price in the greater Austin area increased 5.09% annually. I should mention that this data is all from single family home sales in the entire greater Austin area. If you are looking at home sales in only the city limits of Austin, you will see a slightly different but similar picture. In the City of Austin, the median home sales price has increased every year by at least 5% in every year except 2009 (when it dropped 3%) and 2011 when it only increased 1%. Overall, in the past 14 years, the median home price in the city of Austin has increased 6% each year on average. So what does this data really mean?

The Austin real estate market is strong whether you are buying in the city limits or in the suburbs. While this data is from single-family home sales, similar trends are seen when looking at the data from condo, townhome, and attached ½ duplex sales. If you currently own a home in Austin, your home has most-likely appreciated nicely. If you’re curious what your home is worth now, click here for a free no-pressure home valuation. If you’re considering buying, your money today will likely go further than it will in the future, and look at those appreciation rates! Let your money start working for you rather than throwing it away renting. You can search all homes for sale in the greater Austin area here, or contact me today, and I can show you the best Austin properties for your needs. All data provided was derived from the Austin Board of REALTORS MLS. The Zilker Kite Fest is an Austin tradition. Held annually the first Sunday in March, weather-permitting, the Kite Fest is an event for all ages not to be missed. 2018 marks the 89th anniversary for the festival. This free event features a variety of activities including kite contests, a fun run, and a children’s music concert.

In 1929, the simple kite contest was designed to encourage creativity in children. Now, ABC Home and Commercial Services sponsors the festival and proceeds from the kite fest go to Communities in Schools of Central Texas and the Moss Pieratt Foundation. The contest part of the festival is open to anyone who wants to compete, and there is no entry fee. You may only enter using a homemade single line kite. Participants can compete to win in a number of categories including: largest kite, smallest kite, youngest kite flier, oldest kite flier, strongest pulling kite, most unusual kite, steadiest kite, highest angle kite, and the 50 yard dash. Registration for the contest opens at 11 a.m. on the fourth at the festival, and the contest starts at 1 p.m. This is the first year that there will be a fun run associated with the festival. The 2.1 mile fun run starts at 9 am. You can purchase tickets for the fun run here. The fun run start at the Zilker Moontower, and ends inside the festival near the MossFest stage. For more information on the festival, please visit the ABC Kite Festival website. If you or someone you know is planning an Austin move, contact me today. I’m an Austin native with a plethora of real estate knowledge I look forward to sharing. At the site of the old Cinemark movie theatre in Westlake Hills, across the street from the Barton Creek Mall, The Walsh community has recently sprouted. The Walsh, aptly named for its location off Walsh Tarlton Lane, is a new home community of 55 townhome style residences in Eanes ISD.

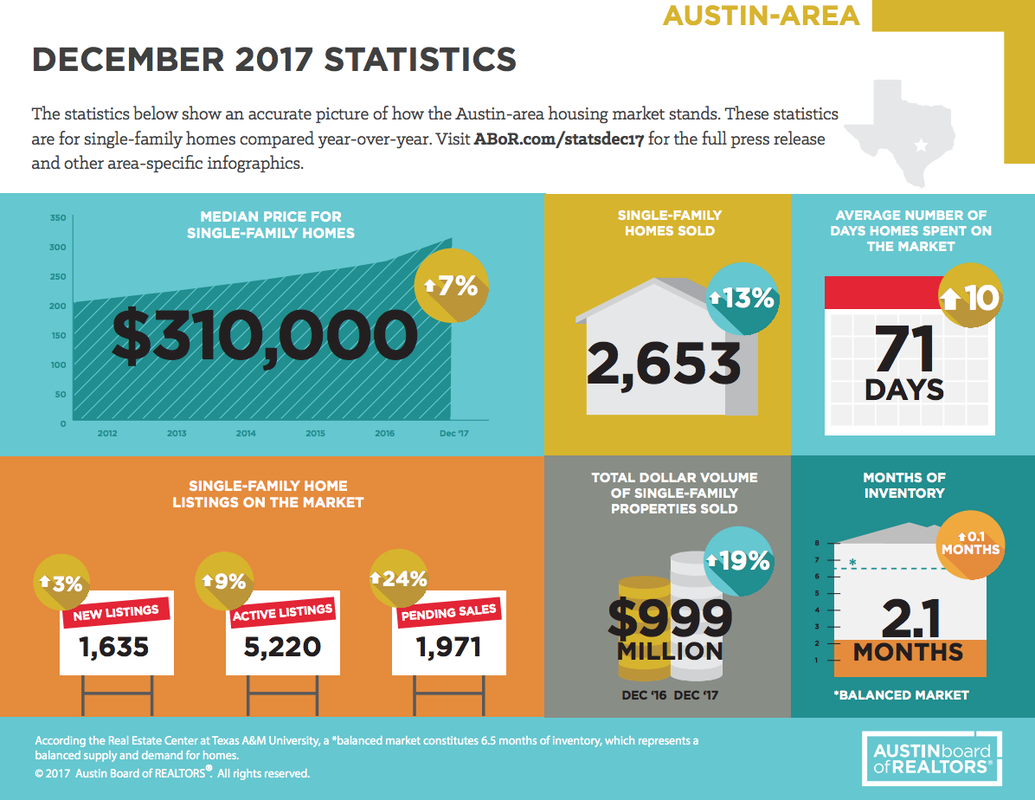

The modern style luxury residences start in the 600s, and all share a similar minimalistic Scandinavian inspired design with an emphasis on geometric details. Inside, you will find finish-outs in line with a luxury product: wide plank oak floors, stainless steel Bosh appliances, oak cabinets, marble, quartz, or honed stone countertops just to name a few. There are eight different floorplans at The Walsh, with homes ranging from 1,961-2,881 square feet. All floorplans have a garage; the larger floor plans have two car garages while the smaller floorplans only have one. The smallest floor plan at The Walsh, The Nils, has 3 bedrooms, 2.5 baths, a one car garage, and a small patio. The first floor is an open floor plan with dining, living and kitchen (something you will find in all units at The Walsh). Upstairs you will find the master, two additional bedrooms and a second living room/bonus space dubbed “the landing”. In comparison, the largest model, The Brit, has three levels, 4 bedrooms and 4.5 baths. On the bottom floor of The Brit, you will find the two car garage, one bedroom, a full bath, and storage space. The Brit also features an elevator that takes you to the second and third floors. The second floor has the master, kitchen, living and dining spaces, and a patio. On the top level, there are two additional bedrooms, another patio, and a large game room. The Walsh is located in the acclaimed Eanes Independent School District. Residences at The Walsh feed to Cedar Creek Elementary, Hill Country Middle School, and Westlake High School. All three schools are less than a five-minute drive from The Walsh. As I mentioned earlier, The Walsh is also conveniently located across the street from the Barton Creek Mall. Here you will find all your big name department stores, including Nordstrom’s, a variety of dining options, and a movie theater. If you’re looking for a new home in Austin, and like the idea of a low-maintenance new construction home in south west Austin, I encourage you to take a look at The Walsh for yourself. You can view more information on The Walsh website, or contact me today to see it in person. Well, December home sale statistics from the Austin Board of Realtors were just released, and sales are steady! In the Austin-Round Rock MSA, single-family home sales increased 13% to 2,653 home sales in December 2017, while median price rose 7% to $310,000 over the same time frame.

Within the city limits of Austin, there were 802 home sales last month with a median home price of $359,150. Within the City of Austin, the Average Days on Market or ADOM went up slightly to 54 days which is not unusual as the market tends to slow slightly around the holidays. Compared to City of Austin home sales in December of 2016, the total dollar volume of residential home sales in December increased 15% to $352 million. There are just under one million residents in the City of Austin, while more than two million people reside in the greater Austin area. In fact, the Austin-Round Rock MSA is the 31st largest metropolitan area in the United States. In the Austin- Round Rock MSA there were 2,653 home sales in December of 2017 bringing the annual home sales total for the MSA to 30,059 sales, an all-time high. If you’re interested in learning more about what’s happening in your specific neighborhood, contact me. I can provide you with a custom Austin real estate market update for your specific area. Between South Congress and I-35, a new community is beginning to come to life. PSW’s North Bluff community consists of 66 free-standing condos. The units range from 1,268-1,675 square feet and start at $295,000. There are seven different home types; however, they all share some great features.

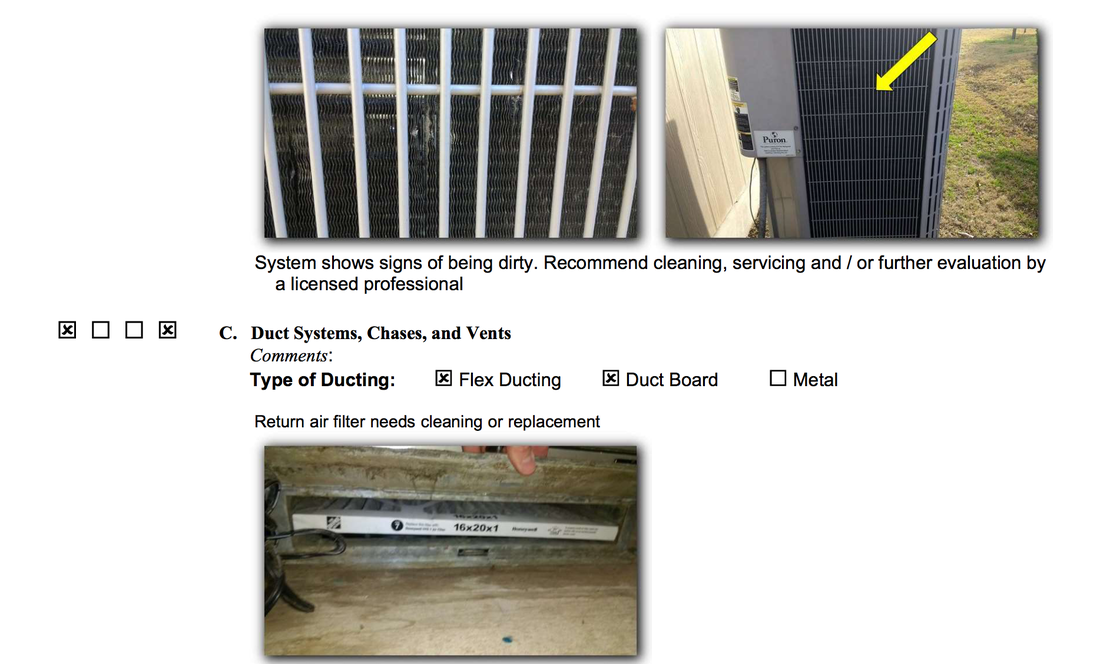

All of the homes at North Bluff feature super high ceilings that amplify the open floor plan living, kitchen and dining spaces. Stainless steel appliances, gas ranges, and engineered quartz counters come standard in the homes, and there is no carpet in the entire community. First floors feature stained concrete, and upstairs there is laminate wood-look flooring. These homes are cosmetically appealing, and they also feature a slew of green features. Low VOC paint and compact fluorescent lights are found throughout the home. High performance insulation is present at the roof and exterior walls. EPA watersense plumbing fixtures and dual flush toilets are installed in the baths, and each unit has a solar photovoltaic panel system. These are just a sample of all of the green features found in the North Bluff community. The community features walking trails, and community green space as well. Keeping with the sustainable theme, the green space features native landscaping. HOA fees are reasonable for the area at $450/quarter. Plus, with all of the green features, your utility costs are likely to be minimal. North Bluff is being built in two phases, and Phase 1 homes are almost complete if you’re looking for an immediate move. If you’re interested in learning more about South Austin’s North Bluff, contact me today. Alternatively, you can check out PSW’s website with up-to date info on pricing and availability. In the past, I’ve discussed cosmetic strategies for preparing your home to sell for the most money. Articles such as 9 Tips to Increase Your Home’s Worth and Prioritizing Upgrades When Preparing to Sell Your Home provide an overview of strategies to increase your home’s curb appeal both outside and inside your home. Conversely, this article focuses on home maintenance and home repairs that you should address prior to listing your home for sale. In an Austin home sale, the buyer has what is called an option period. The option period allows the buyer the right to access and do all necessary due-diligence on a home prior to being locked into the home sale. The buyer has the unrestricted right to terminate the contract during the option period, and the earnest money will be returned to the buyer. It’s strongly recommended that the buyer have a licensed home inspector inspect the property during the option period. Any aspects of the home identified by the inspector as areas of concern, are leverage for the buyer. The buyer can either request the homeowner fix the issue of request monetary concessions for the repairs. These requests are formally submitted to the seller in the form of an amendment to the contract. Probably the most common item I see on such an amendment is the request for the air conditioner to be cleaned and serviced. If you’re preparing your Austin home for sale, you should consider having the AC cleaned and serviced prior to listing your home. Why give the buyer an opportunity to overcharge you for this service? If you tackle this before listing your home, you can take your time comparing quotes from different providers, rather than rushing to have the AC serviced when you’re in the middle of moving or risk conceding more than necessary to the buyer for the service. While you’re at it, you should also replace the air filters. The other benefit to repairing or servicing your home prior to the repairs being mandated in an amendment is that you get to choose who does the work. Once a repair is required per an amendment, the repair must be made by a licensed contractor. If you are handy, you may be able to fix things yourself prior to listing your home or hire an unlicensed handyman who is still qualified for the job. An inspector will note every little thing that is wrong with a home. A door without a stopper will be noted, as will the lack of a smoke detector in a room. I’m not particularly handy, but I could easily install these items. Another item I regularly see on inspection reports is a lack of an anti-tip bracket on the oven. This five to ten-dollar part effectively anchors your stove to the wall so that a child cannot get in the oven and have it fall over leaving them trapped inside. Another item you may consider DIYing is in regards to the exterior of the home. An inspector is going to note any plant growth that creeps up the home as an area of concern since it could lead to wood destroying insects entering the home. Pull off any vines or climbing plants that are making their way up your home. You should also clean out leaves and debris from gutters and make sure gutter spouts are properly diverting away from the home. If your home has flashing, check to see that its properly diverting water off the roof, and away from the home. Grading is also an area of interest for an inspector. Your yard should slope down from your home so that water moves away from the property. If you have any known leaks in your home, it’s best to address these now. Even if you don’t, you may want to check under your sinks and around your toilets to make sure there is no water penetration. Leaks in faucets or sink pipes can usually be addressed quite easily. It may just be a matter of tightening a piece or replacing a washer. You should also address any running toilets. Sometimes it’s as easy as adjusting the flapper chain- an easy no tools required fix. If you have major plumbing issues, it’s best to consult a licensed professional. Another common item on inspection reports is electrical issues. A lack of GFCI outlets is often noted as a potential safety risk. It’s my understanding that if the outlets are properly grounded this is not necessarily an area of concern. However, if you don’t want to be nickel and dimed during the option period, this is another item you may want to address. Any outlets or fans that are not functioning properly should be looked at by a professional, and while you are at it, make sure all your lights have functioning bulbs. An inspector may not be able to assess if a light doesn’t work or if it’s simply lacking a functioning bulb.

These are just a few of the most common repair requests I see. If you’re planning to sell your home, determining which projects are the most important is a complex evaluation. Your budget, and desired sale price will determine the most important projects. Not sure which projects you should tackle before selling your Austin home? Contact me today, and I’ll help you decide which projects will allow you to net the most money in your Austin home sale. It’s that time of year again! If you purchased a primary residence last year, make sure to file your homestead exemption with the county to save some money on your property taxes! You must submit this paperwork by April 30th.

Your Homestead Exemption will be denied unless all of the required documents show the same homestead address. First, fill out the application specific to your county, then mail all of the documents to the county appraisal district. Williamson County even lets you file the paperwork online! Download the residential homestead exemption application for your county by clicking the link below: Travis County Mailing Address: P.O. BOX 149012, Austin, TX 78714-9012 Williamson County Mailing Address: 625 FM 1460, Georgetown, TX 78626-8050 Hays County Mailing Address: 21001 IH 35 North, Kyle, Texas 78640 Bastrop County or Call 512-303-1930 ext. 22 Mailing Address: P.O. Box 578, Bastrop, TX 78602 Burnet County Mailing Address: P.O. Box 908, Burnet, TX 78611-0908 Llano County Mailing Address: 103 E. Sandstone St., Llano, Texas 78643 Include a Copy of your Driver's License or Identification Card: Your driver's license needs to be from the Texas Department of Public Safety (TX DPS) and the address must match the homestead address. Contact me if you have any questions! If you’ve been renting for a while, I’m sure you’ve at one time considered the idea of buying a home. Yearning for a place where I could rip the carpet out, paint the walls whatever color I wanted, and replace the completely unpredictable electric oven was enough to propel me towards making my homeownership dreams a reality. For many people, thinking about buying your first home can seem like a daunting process. In fact, I talk to tons of people who never even considered a home purchase within reach due to the many misconceptions about the home buying process. Maybe you are one of those people who is absolutely sick of paying your landlord’s mortgage. You believe in the fallacy that you have to put 20% down on a home, and have succumb to the idea that you will be a renter for life. Luckily, I’m here to show you just how easy it is to buy a home. There are many options for purchasing a home with less than 20% down. There are even USDA home loans that you can obtain for rural homes for 0% down, and a number of local and state programs aid first-time home buyers with various initiatives including down-payment assistance programs. Your first step towards buying your first home in Austin, is to talk to a lender to determine your home budget. In fact, I recommend you talk to a few. Check to make sure you are getting the best rate possible, and find someone you enjoy working with. Feel free to reach out to me for specific lender recommendations for your needs. Before you start talking to lenders, it is important to gather at least some of the documents your lender will need. Preliminary documents include: w2s, past two years’ tax returns, pay stubs, past two months’ bank statements. A list of ongoing monthly debts such as student loans, car payments, and minimum balances for credit cards is also helpful. Your lender many need additional documents based on your unique situation; however, having these items handy will give you a good head start. Once you submit those documents to the lender of your choice, you will be given a pre-approval letter that notes the maximum loan amount or the maximum amount you can spend on a home. Now, it’s time for the fun part! You will probably have given a little bit of thought into what you want in a home before this stage. Now, you will refine your needs, determine your must-haves, and start house-hunting. Your dedicated REALTOR, yours truly, will help you locate homes that match your criteria, and tirelessly point out the pros and cons of each home. Eventually, we will find the one! When we finally locate the perfect place, the one that is destined to be your future abode, and makes you feel all warm and fuzzy inside, I go into energizer bunny mode. We will determine the best price to offer, discuss if you’d like the washer and dryer to stay with the home, determine if you’d like a home warranty to be included with the purchase, and assess all the other details of the contract. I’ll write up the contract as discussed, shoot it over to you for signatures and then we will submit the offer. If it’s a hot home with lots of interest, we may even craft up sweet letter about how this home is just perfect for you and your golden retriever puppy, Bo. Usually, within less than an hour after deciding you wanted that perfect home with the white picket fence, your offer is in the hands of the listing agent. Once the listing agent receives the offer, she will present it to her clients. They may decide to make some adjustments in which case, we would go back and forth negotiating for what’s best for you but also agreeable to the seller. Or, they may simply accept the contract as is. Regardless, once the contract is agreed upon by both parties, your option period starts. The option period is a set amount of days that you, the buyer, has to do your due diligence on the home and back out if you find anything too scary. We will discuss the exact length of the option period when writing up the contract but usually it’s around 5-10 days. I’ll send you recommendations for inspectors, and we will schedule one to come out and thoroughly evaluate the home. I’ll meet with him after to discuss the findings, and if possible I highly encourage you, my clients, to come too. After the inspection, we will discuss the results. If there are repairs that need to made to the home, we can either request that the repairs are made prior to the closing date, or request that the sellers give money for the repairs at closing. Ultimately, this becomes another back and forth situation which cumulates in an official amendment to the contract. Along the same time, that we are reviewing the results of the inspection, the lender is working to order an appraisal on the home. For the home buyer, this is not really a hands on part of the process. The lender will notify you that the appraisal has been ordered and will let us know when it comes back, hopefully at or above the offered value. At this stage, there is a slight lull in the process. At the beginning, your moving quickly looking at homes, writing offers, negotiating. Now, you’re mostly waiting. Waiting for the appraisal to come back, and you may be submitting additional documents to your lender. Once your lender has the appraisal and all outstanding documents, your file is submitted to underwriting. At this point, you will choose a home insurance policy, a home warranty if you’d like one, and eventually you will hear the sweetest words you’ve been granted “clear to close”. The day before closing, or the morning of, it’s always prudent to do a final walk-through. You will want to see with your own eyes that the home is in the agreed upon condition, and that any repairs negotiated during the option period have been completed to your satisfaction. The next stop is the title company where will you sign your life away, and become a proud first time homeowner. Unfortunately, you don’t usually get the keys right away. Once you’ve signed everything, the documents are sent back to the lender and as soon as the loan funds, you get the keys. This usually takes a few hours, so if you’re so inclined, I’d highly recommend a spontaneous mid-day happy hour to celebrate your new status as a proud first time home buyer. After a few margaritas, or maybe a bottle of champagne, the time flies by. Suddenly a consistent vibration or an ascending chime disrupts the chatter; upon answering you find an upbeat title employee telling you the time has finally arrived. Now, you can pick up the keys to the place you will call home.

If you’re sick of renting, and ready to take the plunge into home ownership, contact me today, I’ll show you just how easy it is to buy your first home in Austin, Texas. |

BLOGSharing Austin real estate updates, home owner tips, & more. Archives

February 2024

Categories

All

|