|

Everyone knows that having a remodeled kitchen or a large backyard will affect the resale value of your home; however, did you know that being closer to a Starbucks correlates with a higher sales price? According to research from Zillow, “Between 1997 and 2014, homes within a quarter-mile of a Starbucks increased in value by 96 percent, on average, compared with 65 percent for all U.S. homes”

Having your morning cup of joe close by adds value to your home, but there are a number of items that may negatively affect the value of your home. You may want to use caution when considering a property with electrical poles on the lot. Many buyers fear electrical poles; be particularly cautious when purchasing a property with transformers on the lot. Some people believe these are linked to certain health risks. Others simply don’t want someone entering their property every time a major storm causes a power outage. I also recommend looking at the title policy closely when purchasing a property. Keep an eye out for any easements noted. These may be for utility companies or a variety of other reasons. Convenience to local transportation can also affect the value of your home. I have heard horror stories of people purchasing a home and later realizing that a daily train made such a racket they could not live comfortably in the house. Also be cautious of purchasing a property on a busy street. That being said, in some areas, being close to public transportation may actually be positive, thus, increasing the desirability of the property. These tips are good eye openers. However, they are not all encompassing. If you are considering making a purchase and resale value is important to you, contact a real estate professional for an in-depth analysis.

1 Comment

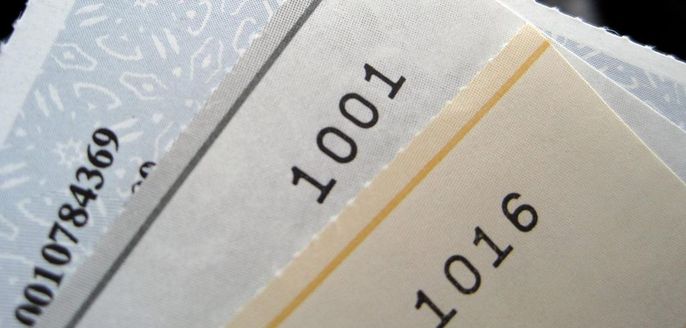

Do you understand the difference between earnest money and option money? My clients in the Austin area often ask me about the difference between option money and earnest money. In Austin, and the rest of Texas, the buyer must provide two checks once under contract for a property. Both must be delivered in a timely fashion, and are usually used in residential transactions in Texas.

The option money is non-refundable; however, a good real estate agent, like myself, will make sure the contract specifies that the option money will be applied to the sales price if the buyer determines they want to move forward with the purchase during the option period. The option money is essentially payment to the owner for the right to enter the property and perform any inspections or due diligence necessary within a specified amount of time. This check is made out to the seller, and the seller can cash it immediately. The amount of option money and the length of the option period are specified in the contract; however, both are negotiable amounts. A good general rule of thumb in the Austin real estate market is that the option money should by .1% of the sales price. Thus, for a home with a sales price of $300,000, a $300 option fee is generally an acceptable amount for a 7 day option period. The option period countdown begins the day after the contract is executed and commences at 5 p.m. on the specified date. For example, if you had a 7 day option period, and the contract was executed on the 9th, the option period would end on the 16th at 5 p.m. Holidays and weekends DO NOT matter when determining the date the option period ends. If the real estate market is incredibly competitive, such as the current Austin market, a shorter option period and/or a higher option money amount is more favorable to the seller. If the buyer backs out of the contract during the option period, all he or she will lose is the option money, and any money spent on inspections. The seller prefers a shorter option period since he or she must essentially remove their home from the market while the buyer is "in their option period". Although the home is not technically off the market, many Austin real estate agents will not show homes that are under contract or "pending back up" status in the MLS. Similarly, a higher option money amount demonstrates a greater interest in the home since the buyer has more to lose if they decide to back out of the contract during the option period. The earnest money check is made out to the title company that will be handling the transaction. The earnest money will also be applied to the sales price of the property, and similarly shows what is called consideration. Essentially, these are the "money talks" portions of an offer. By delivering the earnest money check, the buyer is demonstrating serious interest in and an intent to purchase the specified property. It is common practice in Austin for the earnest money amount to be 1% of the sales price. If we return to the earlier example of a $300,000 sales price, this equates to a $3,000 earnest money check. Again, this is just a recommended amount and can be any amount agreed upon by both parties. The earnest money check is also "cashed" by the title company. The money leaves the buyer's account and is held in an escrow account. If the buyer backs out of the contract during the option period, the earnest money will be refunded to the buyer. Understand, this is a major difference between earnest money and option money; the option money is not refunded if a buyer backs out. After the option period, the earnest money is essentially held to make sure both parties comply with the requirements of the contract in the time frames specified. There are a number of clauses that protect the buyer's right to have the earnest money refunded if the seller fails to comply with certain provisions within specified time frames. For example, if the contract specifies that the seller must deliver the seller's disclosure statement within 10 days of the executed date, and the seller fails to do so or delivers it on day 12, the buyer may terminate the contract, and the earnest money will be refunded to the buyer even if they are outside of the option period. For more example, check out this Austin law firm's post on earnest money refunds in Texas. Do you understand the difference between earnest money and option money in a Texas real estate transaction now? Want to take a look at homes for sale in Austin, view available houses for sale in Austin now. If you have any further questions about option money or earnest money, or real estate in general, reach out to me directly! by email [email protected] or phone 512-779-7597 Do you want to sell your home for the most money without spending a fortune preparing your home for the sale? Take a look at these 9 tips to increase your home’s value without breaking the bank.

1. Spruce up your front yard The first thing a potential buyer is going to see when they look at your home is the outside. You want to deliver a great first impression. Plant flowers in the front yard, power wash your sidewalk and porch leading up to your front door, and make sure leaves are raked regularly. It's also a good idea to put a fresh coat of paint on your front door. 2. Paint! A fresh coat of paint can do wonders for your home value. Paint the inside walls of your home a neutral color to brighten the room and make it appear larger. Cans of paint generally cost around $25, so grab a few and start sprucing up those rooms. If you don’t want to paint the entire wall, make sure to touch up any scratches or dings. 3. Replace handles and knobs You might not be able to afford brand new cabinets in every part of the house, but you probably can afford some new handles. Purchase new handles or knobs for your cabinets in the kitchen and bathroom to give the rooms an updated look. 4. Re-Caulk the Kitchen (and Bathrooms) Caulk can get yellow and brittle after a few years, especially around sinks and bathtubs. Make your kitchen and bathroom look like new by re-caulking. A tube of caulk costs around $5 and can update a home's look (and value!) 5. Match your Appliances Is your mix and match kitchen giving you a headache? Did you know, you don't have to buy brand new appliances that are all in the same hue – most appliances have front panels that can be removed and replaced. Give your appliances a facelift by buying matching front panels to give your kitchen a consistent feel. 6. Clean! I mentioned the first impression at the beginning of this post. If a buyer enters a home that's dirty, it will be hard for him or her to look past the state of the home. Clean your floors, windows, walls and baseboards. Give your home a good scrubbing. This will let in light, allow buyers to see the views and increase the marketability of your home. You will also want to de-clutter and de-personalize. Remove family photos and religious items. Another trick I like to tell my Austin sellers is to remove about half of the items in your closets and pantries so they appear larger. 7. Lighting Outdated fixtures can make a home less appealing to prospective buyers. You can spend a decent amount of money replacing fixtures, but you don't have to spend so much to get the same results! Purchase discounted lampshades to perk up an older lamp, and change switch plates on your light switches to give your home an updated look. Make sure your switch plates and outlets match throughout the home. 8. Replace faucets Purchase a new faucet for your sink and shower in your bathroom, and you'll increase your home value. Make sure the faucets for the sink and shower match – most of the time new faucets will cost around $30 to $60. It's not a bad idea to update your kitchen sink faucet, too! 9. Update your flooring Another part of the home that ages a house is the flooring. You may want to have wood floors refinished or concrete floors polished. Rugs or carpet that have gone out of style or seen better days can decrease your perceived home value. If you have enough money to replace the carpeting, go for it! However, if it’s not in the budget, you may want to display a sign with carpet swatches that advertises an allowance will be given to buyers to replace with their preferred carpet after closing. Some of these hacks are borderline genius, some you may have heard of, but here is my list of home hacks sure to save you time, money or at least a trip to the store.

1. Use a walnut to remove scratches from wood furniture. 2. Clean a shower curtain liner in the washing machine. Seriously just throw it in the washer with some towels and detergent. 3. Clean your disposal with vinegar ice cubes. Add some lemon or rosemary to an ice tray, cover with vinegar and freeze. When your disposals smelling funny, add a cube and turn it on. 4. You can also use vinegar to clean your shower head. Fill a plastic bag with vinegar, place it around the top of the shower head and tie it on. Let it sit for 30 mins- 1 hour and then remove. 5. Use a pillow case to clean your fan blades. 6. Clean your sponge in the microwave. Just throw it in there on a microwave save dish and heat on high for 2 minutes. 99.99 % of germs instantly eliminated. 7. Get rid of dust in exhaust fans with compressed air (the kind you use to clean your computer) 8. Use a dryer sheet to remove dust from base boards. This also works great for TV's and other electronics. BONUS TIP- a used dryer sheet is perfect for removing deodorant stains from clothes Remember, I'm always here for you and your friends. If someone you know is looking to make a move, don't hesitate to give them my information. I'd love to personally help or refer them to someone in their city. A rainy day in Austin in generally quite rare; however, we've been having quite a few lately. Naturally, that spurs the question, what's one to do in Austin when the weather is less than superb? Don't let the clouds put a damper on your day, the city still has plenty to offer when the sun isn't shining.

Soco Strip: Along South Congress, you will find a variety of boutiques and trendy stores. You can find everything from vintage threads to upscale jewelry. Don’t miss Uncommon Objects for a slew of unusual antiques and random finds or Lucy in Disguise for an epic assortment of costume wear.

Barton Creek Mall: For a more traditional shopping experience, visit the Barton Creek Square Mall. Here you will find all of your big name department stores including a Nordstrom. Among the 180+ stores are Sephora, Apple, Lucky, Sunglass Hut, Gap, and many more. Hill Country Galleria: The Hill Country Galleria offers a pleasant outdoor shopping experience for all. It is composed of a variety of local boutiques and well-known stores such as Victoria’s Secret, Dillard’s, and White House Black Market. The shops at the Galleria across the highway offers more big box stores such as Best Buy, Ulta, Michael’s and Marshalls. The Drag: The Drag refers to the strip of stores on Guadalupe adjacent to the University of Texas. This stretch of stores includes a variety of stores that mostly cater to students including hip boutiques, vintage stores, and campus bookstores. The Domain: The 304 acre thoughtfully planned Domain community offers a large outdoor shopping area. Most of the stores are familiar names such as H & M and Apple; however, you will also find a few local shops. The Arboretum: The Arboretum at Great Hills is another great open-air shopping center. It includes shops such as Pottery Barn, Gap, Barnes & Noble, and Jos. A. Banks. Don’t miss the iconic Austin marble cow sculptures! In an effort to increase the current housing stock and prevent locals from being pushed out to the suburbs, the City of Austin has passed a number of initiatives to ease the process of adding a granny flat to your lot. A granny flat, often referred to as an accessory dwelling unit (ADU) or secondary apartment, is a secondary residence located on a traditional single family lot. Originally, the ordinance allowed for the development of granny flats on lots of at least 7,000 square feet. However, recent amendments seek to increase the feasibility of granny flat development by reducing the lot square footage requirements to 5,750 square feet for certain neighborhoods. In effect, the city allowed each neighborhood association to vote on this measure- determining if granny flats would be allowed on lots smaller than 7,000 square feet. If you are considering building a second unit on your lot, and you have a smaller lot, you must go to the City of Austin's Development Services Department. A city employee can pull the zoning overlay for your particular neighborhood in order to determine if building a granny flat on your lot is feasible. Regardless, you will have to comply with a number of other regulations in regards to accessory dwelling units in addition to complying with traditional zoning requirements. The full code is located here, below are some highlights:

Granny flats represent a great opportunity for Austin to expand the affordable housing stock available, increase density while limiting urban sprawl, and allow residents to make a profit on their existing investments. On June 13th, 2015, the city council voted to re-evaluate the current code for ADUs; specifically, residents hope they will limit the cumbersome parking and driveway requirements in addition to reducing impervious coverage requirements. Building a granny flat is a great way to add value to your current home. If you're worried about the hassle of red tape involved, feel free to give me a call. I'm happy to walk you through the process. |

BLOGSharing Austin real estate updates, home owner tips, & more. Archives

February 2024

Categories

All

|