|

Congratulations! You have finally found a house that you want to call home! Once you are officially under-contract (which means that you submitted an offer on a house, and the sellers have accepted the terms and signed the offer to acknowledge the acceptance), there are a few things you will need to do right away! First things first, if you are using a loan to purchase the home, make sure your lender has a copy of the executed contract. This will ensure that he or she gets the ball rolling on the funding side. Next, you will need to write two checks, the option money check and the earnest money check. The amounts for each of these checks will already be determined in the contract. You will want to make the option money check out to the sellers and the earnest money check out to the title company. You have three days to submit these checks. For the earnest money check, that means three business days since that check is going to the title company and they probably won’t be open over the weekend. For the option money check, that one must be delivered within three real days. This sounds pretty easy in theory, but in reality it can be a bit trickier to execute. What if you are out of state, and the contract is executed late on Friday? You may need to have the checks overnighted, or sometimes, you can wire the total amount for both checks to the title company and the title company will cut the option check out of the total wire. Aside from making sure your two checks get to the appropriate parties on time, you also will want to schedule your inspections. A home inspection is always a prudent choice. The inspector will go over all the various aspects of your home with a fine tooth comb, and point out any areas of concern. You may want additional inspections during the option period too. If the home is on a septic system, it’s a good idea to get a septic inspection. Likewise, if it has a pool you may want to get that inspected too. The option period is your time to do any and all necessary due-diligence on the property. If there is something unveiled that’s a deal breaker, you can back out of the contract without losing your earnest money. You may also consider scheduling some contractors during the option period. If you’re planning to remodel or make any structural changes to the home, you can get quotes and advice from qualified contractors during this time. If purchasing this home is contingent on being able to remove a wall, and the contractor reveals it will cost way more than you can afford, you can still back out of the contract during the option period. Before your option period ends, you have the opportunity to renegotiate. If there were serious issues revealed in the inspection, you can prepare an amendment to state that the seller will either fix these issues, or you can negotiate money off the sales price so that you can complete these repairs. This is not the time to ask for $5k off the sales price because you don’t like the color of the home. This amendment should only be used to address concerns that you were not aware of until the inspector pointed them out to you.

If there are concerns you would like addressed, you will present your proposed solution to the seller. If the seller agrees to fix the issues or give you money off the sales price, you will both sign an amendment to the contract clarifying this agreement in writing. If you cannot come to an agreement, you can either back out of the contract or proceed with the sale knowing that you are going to have to fix these issues at your own expense after closing. It’s important to schedule all of your inspections early in the option period to allow the time to review the findings and negotiate with the sellers if necessary. While you can still negotiate repairs after the option period, you have little leverage after the option period is over since you no longer have the ability to back out of the contract without losing your earnest money. Once, the option period is over, there will be little for you to worry about until the closing date. You may need to provide more documentation to your lender, and if the home doesn’t appraise that could be another opportunity to negotiate the sales price. If you have questions about the buying process in Texas, feel free to contact me today. I’d be honored to help guide you through the process of finding a house to call home.

1 Comment

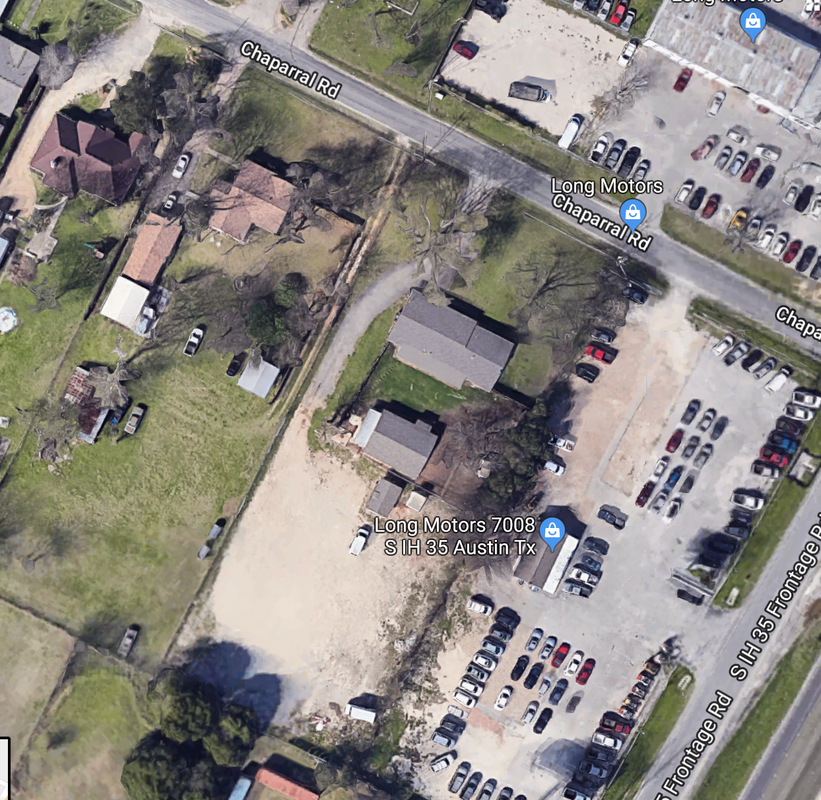

Around April 15th, you should have received a Notice of Appraised Value from the Travis County Appraisal District (TCAD). This notice includes the market value and the assessed value for your home. If you feel that the value is not correct, you can protest your assessed value. It’s worth mentioning that if you feel that the TCAD provided value is less than the market value, you should not protest! A homeowner should protest the assessed value if doing so could result in lowering your property tax bill. You can hire a professional company such as Five Star Tax Professionals to protest your home’s value on your behalf, or you can do it yourself. Travis county provides two ways to protest your property tax bill. You can do so electronically by e-filing, or you can do so by mail. Included with the Notice of Appraised Value mailed to you by Travis County around the 15th of April is the Property Appraisal-Notice of Protest Form. While e-filing seems like the best option, I advice you NOT to e-file, and instead to file by mail. If you e-file, you never receive the opportunity to present your case to a real person. By presenting in person, you have a much better chance of actually receiving a reduction in the assessed value of your home. If you can't find your original copy of the protest form, you can download it here. How to Fill Out the Notice of Protest Form: Step 1: This section should already be filled out for you. Verify that the information is correct. Do NOT add your email. In small print at the bottom of the form it states, “by including the email address on this form, you are affirmatively consenting to its release under the Public Information Act.” So unless you love receiving spam email, leave it off! Step 2: Again, this section should already be filled out with the address and property ID number. Confirm it is entered correctly. Step 3: Check the first two boxes: incorrect appraised (market value) and value is unequal compared to other properties. By checking both of these boxes you will be allowed to bring the most ammunition to fight your case that the county has assed your property value too high. Step 4: Do not give any facts here. Instead write in, “please mail evidence packet”. The county must then legally mail you the supporting evidence they have for the assessed value you have been given. This information will help you build a case against why their valuation is incorrect later. Do NOT write in what you think the property’s value is. This is a trap! Step 5: Check “in person”. This allows you the opportunity to present your case in person to a real human! Step 6: Select “Yes” to be mailed a copy of the CAD evidence report. You may also want to write in “and field card” to ensure they send you all evidence pertaining to your home’s assessed value determination. Step 7: Sign and Date Once you have filled out the form, do NOT immediately rush to mail it in to TCAD. Instead put it on your fridge, and make a calendar alert to mail it in as late as possible! Hearing dates are assigned based on the date TCAD receives your protest form. If you’re hearing is later on, you will be able to use the previous successful protests as evidence to lower your homes assessed value. You must mail it in May 15th, so I recommend setting a calendar alert for the 13th or 14th. Then, send in the protest form by certified mail so you have a receipt for the mailing. After you have filed your Notice of Protest, it may take several months for TCAD to send you information on your informal hearing. Eventually, you will receive a date for the informal hearing. This hearing is the opportunity for you to present all of the evidence that the county has over-valued your home. Types of Evidence to Bring: Comparable Market Analysis: Ask your favorite real estate professional (Ahem, ME) for a report of recent comparable sales. This report will show sales prices for homes that are similar to yours in condition, location, and size. Home Condition Documentation: Is there anything wrong with your home that negatively affects the value? Is there a major plumbing leak, or significant foundation problems? Take photos or provide quotes from contractors so that you can illustrate these faults. Neighborhood Conditions: Does your home back up to a hobo camp? Is there a noisy street adjacent to your home that adversely affects your market value? If there is anything in the immediate vicinity of your home that negatively affects the market value of your home, take photos, screenshots from google maps, and any other evidence that will allow you to illustrate this point. Sales Documentation: Did you recently purchase your home? Was the sales price lower than the assessed value? If so, bring a copy of your final settlement statement. Bring extra copies of all documentation to the informal hearing! At the end of the hearing you may be offered a reduction in value by the district. If you are satisfied with the reduction, you can accept. If you are not, you will be able to protest at an official hearing. Before the official hearing you have the right to see all of the documentation that district appraisers will be presenting. Make sure you obtain this information, so you can properly build your case against it. Maybe they are comparing your home to a neighbors that you know is way nicer, has a pool in the back and is obviously worth way more than your home. You can obtain evidence to illustrate this fact. If similar homes to yours in your neighborhood have successfully protested their value it’s a good idea to compile this information as well. You will want to bring all of this evidence in addition to the evidence you compiled for the informal hearing on a flash drive to be used during the hearing. Additionally, it’s a good idea to bring a hard copy for your reference. If you have any questions about fighting your assessed value in Travis County or general real estate questions, please don’t hesitate to contact me. |

BLOGSharing Austin real estate updates, home owner tips, & more. Archives

February 2024

Categories

All

|