|

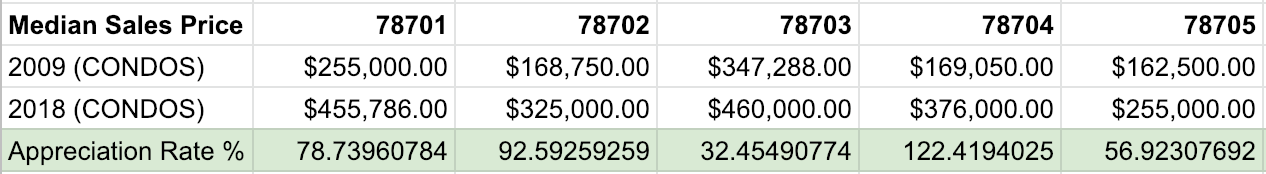

Recently, I was showing a client of mine some condos in central Austin. She was trying to decide between a condo in Clarksville and a condo in 78704, and she asked which area appreciated better. From the seat of my pants, I speculated that 78704 condos have appreciated more than Clarksville condos. This hypothesis was based on the fact that Clarksville condos have been pricier for some time, so it seemed logical that the 78704 condos would have appreciated more in the past ten years or so. When I got home, I ran some numbers. I looked at the median sales price annually from 2009-2019 for condos in the following central Austin zip codes: 78701, 78702, 78703, 78704, 78705, and 78751. I then calculated the appreciation rate for condos in each zip code between 2009-2018. The median sales price for 2019 would not have provided accurate data since we are only a few months in to 2019. As I suspected, condos in 78704 appreciated more than condos in Clarksville (78703). In fact, condos in 78704 had the highest appreciation rate out of all of the central Austin zip codes. In 2008, the median sales price for condos in Austin’s 78704 zip code was just over $169k. In 2018, that number shot up to $376K. In 78704, we are seeing a lot of condo regimes. A condo regime happens when a developer takes a traditional single family lot and constructs two new units on the lot. Often times these units are not attached and live like single family homes. However, they are technically condos and sell for much more than a traditional condo. Thus, I am not surprised by this appreciation rate. In 78703, which consists of Tarrytown, Clarksville, and Old West Austin the median sales price for condos in 2009 was a little over $347K, compared to $460K in 2018. Out of all the central Austin zip codes I looked at, 78703 had the lowest condo appreciation rate at just over 32%. As would be expected, condos in East Austin appreciated well over the last 9 years. In 78702, the median sales price for condos in 2009 was about $168K. Last year, that figure jumped to 325K. Condos in downtown Austin appreciated about 78% between 2009-2018. In comparison, condos in 78705, which encompasses the UT campus area, appreciated about 57%. Overall, condos in central Austin have appreciated well. If you talk to anyone who purchased a condo about 10 years ago, they will usually tell you one of two things, “I wish I bought more” or “I wish I hadn’t sold 5 years ago, even though I thought I was making a killing when I sold.” If you are considering buying a condo in central Austin or are curious how much your condo is worth, contact me today. Central Austin Condo Appreciation Video

1 Comment

There’s nothing better than being able to wake up in the morning and enjoy a cup of coffee while you look out at the lake and see the sun reflecting off the water. If this sounds like a little slice of heaven to you, you may be considering purchasing a home with a lake view. In Austin, there are two main lakes, Lake Austin and Lake Travis. I should mention that both “lakes” are really damned portions of the Colorado River. Regardless, us Austinites refer to them as lakes, and you can find wonderful homes with great views of the water near both of these lakes.

Lake Travis is much larger than Lake Austin. Lake Travis is about 25 square miles opposed to Lake Austin’s 2.5 square mile size. So, as you might imagine there are many more homes for sale with Lake Travis views than Lake Austin views.

The south shore of Lake Travis consists of neighborhoods such as Hudson Bend, Lakeway, and Spicewood. These communities are located about 20-30 miles west of downtown Austin in the the Lake Travis Independent School District (LTISD). According to niche.com, LTISD is rated the #2 school district in the Austin area. The north shore of Lake Travis consists of neighborhoods such as Volente, Jonestown and Lago Vista. The north shore communities of Lake Travis are about 20-40 miles from downtown Austin. However, in my opinion, it seems it usually takes longer to get to these neighborhoods from downtown than it does to get to the south shore communities. Homes with lake view on Lake Austin, can similarly be categorized as homes on the south side of the lake verse homes on the north side of the lake. However, closer to downtown they are often categorized as west of the lake or east of the lake. Residents of neighborhoods like West Lake Hills (west of Lake Austin, duh) and Tarrytown (east of Lake Austin) can usually get to downtown in less than 20 minutes. Further out, you can find homes with lake views in neighborhoods such as Cuernevaca, Lake Pointe, and Apache Shores (all south of the lake). On the north side of Lake Austin you can find homes with lake views in Steiner Ranch, River Point, and Cat Mountain. If you’re thinking about purchasing a home in the Austin area with a lake view, feel free to contact me for insider information on the best neighborhoods for your specific needs. As someone thinking about a move to Austin, I’m sure you may be curious about how much you should expect to pay in property taxes for any given home. Property tax rates vary drastically across central Texas, and it’s important you have a good estimate of what this cost will be before you buy a home. Your annual property taxes will be calculated using the county's appraised value of the home and the tax rate for that specific property. If it’s your primary home, you can apply for a homestead exemption reducing the amount of your total annual property tax bill. However, you have to know the tax rate to even have a rough idea of what you may expect to pay in property taxes! Until today, I didn‘t realize just how hard it was to search for this critical number. It’s almost impossible to search for homes with low property taxes in the Austin area. I scoured hundreds of websites and did not find one that had a search field for property tax rates. Luckily, I have the ability to search for Austin homes with low property tax rates in the MLS. I know, ideally you don’t want to talk to me. What you really want is to be able to just search for it yourself! But, since this isn’t an option right now, and I have yet to create what you really want (a great search interface that lets you search for the EXACT home you want with as many search fields as possible), I thought I would try to make the search just a little easier for you!

You can click any of the following links to view Austin homes for sale with a low property tax rate. Homes and Condos within 10 Miles of Downtown with a Property Tax Rate Under 2% Homes in the Greater Austin Area Under 500K with a Property Tax Rate Under 2% Homes in the Greater Austin Area Under 300K with a Property Tax Rate Under 2% Homes in the Greater Austin Area Under 300K with a Property Tax Rate Under 2.3% These links were created on 2/10/19, and the results will not stay relevant forever. If you want better results and a more customized search, feel free to text, email or call me. Once you let me know exactly what you are looking for, I can set you up to get updates for all Austin area homes that meet your unique search criteria including a low property tax rate :) In real estate, a right of first refusal is a contractual right that gives the holder the option to purchase a specified property when the owner decides to sell. This right of first refusal is usually written up by a lawyer, and the terms are agreed upon by the owner of the property and the holder of the right of first refusal. A right of first refusal may be used in a variety of situations. Recently, a client of mine inquired about obtaining a right of first refusal on his neighbor’s vacant lot. He was potentially interested in purchasing the lot, and if the owner was going to sell the lot, he wanted the first opportunity to do so. In this way, he could control his own personal quality of life. If someone else was going to buy the lot and build a massive home that would encroach upon his sense of privacy, he could exercise his right of first refusal and purchase the lot. You also may see the right of first refusal used between a landlord and his tenant. If the tenant likes the home, and would someday like to purchase the property, he may seek a right of first refusal to secure this option. As an owner of a property, your initial thought may be that a right of first refusal is a win-win scenario for you. Either you sell the property to the person who initially submits an offer to purchase, or the holder of the right of first refusal purchases the property. However, in reality this may not be the case. If the wording is not incredibly black and white, and there are not strict timelines, you may be stuck unable to sell the property. If you are considering signing a right of first refusal, you should work with an attorney to make sure the terms are incredibly clear and leave no room for different interpretations. In another recent transaction, I was representing the buyer of a condo. The condo association documents revealed a right of first refusal clause that granted the developers and their successors +21 years, the right to purchase any condo unit in the development. In this right of first refusal clause, it specifically states that if a condo owner receives an offer on his condo, he must provide written notice to the developer (ie the holder of the right of first refusal) and the developer shall have the right to purchase the subject unit upon the same terms and conditions in the initial offer. However, this wording which was drafted in 1973, reveals a lot of ambiguity. My client’s initial offer involved a cash transaction with a closing seven days after the execution of the contract. The holder of the right of first refusal exercised her right of first refusal, but she failed to match these terms. Unfortunately, there was no recourse for the seller. The right of first refusal is worded strongly in favor of the holder. In this scenario, which has yet to come to a conclusion, so far everyone lost. My client was not able to purchase the property. The seller was not able to sell the property, and the holder of the right of first refusal has not proved capable of purchasing the property. The issue with this right of first refusal clause was that the holder had all the leverage. There was not a strict timeline for the holder to waive or exercise the right of first refusal, and there was a lack of specificity in regards to the terms of the contract. If I was a property owner considering signing a right of first refusal, I would make sure that the holder had a very tight timeline to waive or exercise the right of first refusal, probably less than a week. Furthermore, I would make sure that if the holder exercises the right of first refusal they must do so in a specified time frame, and if he fails to close in that timeline, the right is automatically waived.

If you are considering signing a right of first refusal, I recommend you hire an experienced attorney to make sure you do not fall victim to the same scenario. Likewise, if you are thinking of buying a property where a right of first refusal exists, do your due diligence and make sure you fully understand the terms of that right before you waste your time and money on a purchase that may never come to fruition. If you would like recommendations for experienced real estate attorneys in the Austin area, don’t hesitate to contact me. |

BLOGSharing Austin real estate updates, home owner tips, & more. Archives

February 2024

Categories

All

|