|

Oftentimes, I’m working with one of my Austin clients, and we are discussing the various options that are best for their needs. I’ll be speaking quickly, excited to share my real estate knowledge with them, and I will throw out some industry specific term. They interrupt, “what the hell does that mean” or “CMA, what does that stand for”? A CMA is a comparative market analysis, used to illustrate a property’s relative value in comparison to other recently sold properties. Another such term that often is received with a furrowed brow or an inquisitive glance is "warrantable condo".

Condominium buildings are either warrantable or non-warrantable. It is important to know the difference between the two types when you are purchasing a condo, and imperative to know the difference when you require financing to purchase the condo. A condo is warrantable when a loan used to purchase a condo can be sold to Freddie Mae/Freddie Mac. Conversely, a non-warrantable condo is one in which the loan used to purchase the unit cannot be sold to Fannie Mae/Freddie Mac. If you are considering purchasing a non-warrantable condo, that does not mean that you cannot use a loan to do so. However, you will want to make sure your lender is able to provide a loan for a non-warrantable condo. Also, in most cases, lenders require a larger down payment when purchasing a non-warrantable condo. A lender can help walk you through these intricacies when you are financing a condo. However, first, I’m sure you want to know what exactly makes a condo non-warrantable. The Federal Housing Finance Agency (FHFA) determines the guidelines that define which loans can and cannot be sold to Fannie Mae & Freddie Mac. The FHFA is a regulatory agency; therefore, loans that are non-warrantable are considered riskier by the FHFA. However, these guidelines are not black and white. Sometimes, a condo project has an element that makes it non-warrantable. However, purchasing that condo is not necessarily a risky investment. In fact, both Fannie Mae and Freddie Mac occasionally make exceptions to the eligibility requirements based on specific property attributes or economic conditions. Generally speaking, the following factors determine the warrantability of a condominium complex:

If a condominium development is involved in any kind of lawsuit, it is unlikely that the condo units will be warrantable. There are a number of additional variables that determine if a condo is warrantable. For more specific information on Freddie Mac’s requirements, click here. For more information of Fannie Mae’s requirements, click here. If you are looking for a condo in Austin, give me a call today. I’d love to help you navigate the Austin real estate market!

1 Comment

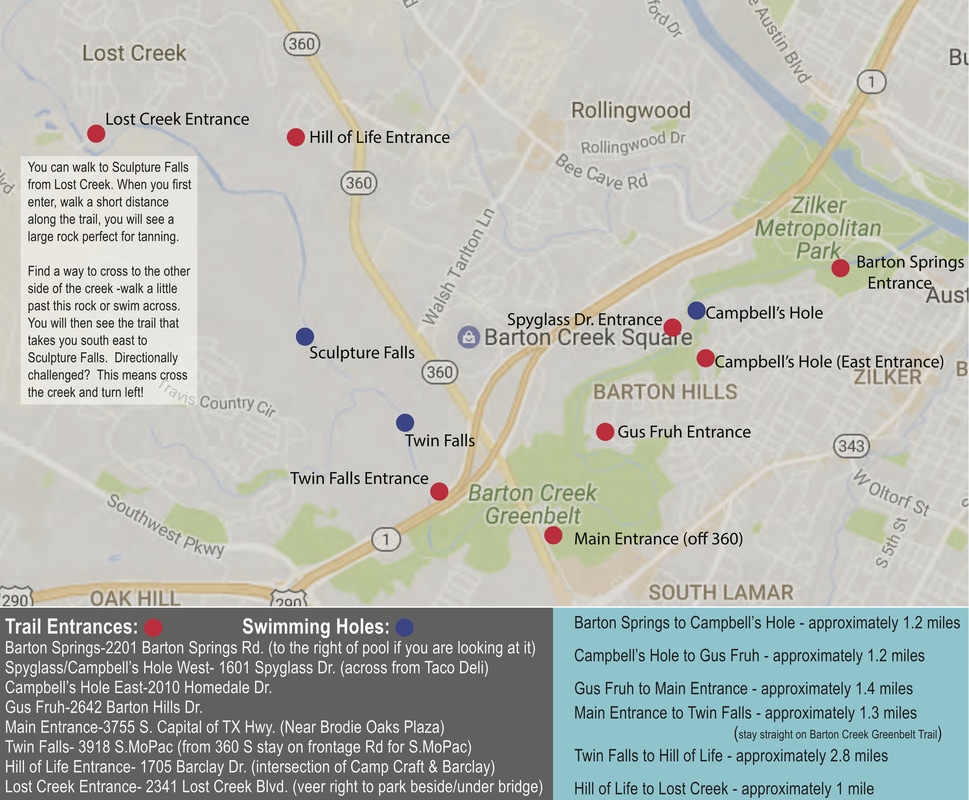

The greenbelt, as Austinites commonly refer to it, is actually the Barton Creek Greenbelt. It contains a little more than 12.5 miles of fantastic trails. Year round, this is a great place to go hiking, running, or biking. Additionally, there are a number of great spots to go rock climbing as limestone cliff faces often line the trails along the greenbelt. However, when there's enough rain, a number of wonderful swimming holes arise, and one can also go tubing or kayaking.

My map below highlights the different access points and swimming holes found in one of Austin's most treasured places, the greenbelt. Since we don't usually get a ton of rain in Austin, some of these swimming holes may be dry at certain points. In my experience, the north western swimming holes, such as the one by the Lost Creek entrance and Sculpture Falls, tend to hold water better than the south eastern Campbell's Hole. Campbell's Hole (pictured above)tends to be shallower and offer intense currents, especially after a large rain fall. The entire trail is great for hiking and biking; however, the Twin Falls entrance offers a bit more variety if you are mountain biking. If you enter through the Spyglass entrance and turn right, there are a few good climbing spots, and the main entrance off 360 near the Brodie Oaks Shopping center is also popular among climbers. It is important to note that a number of these Austin greenbelt access points are located in residential neighborhoods. Please be respectful, and don't forget to take home whatever you brought in with you! With the rise of popular sites such as Airbnb and Homeaway, a growing number of Austin residents are considering renting their properties out as short term rentals. Renting your home out during events like SXSW and the Austin City Limits can easily provide you with enough money to go on vacation yourself and pocket some extra cash.

However, there are a plethora of regulations one must be aware of in order to earn extra money hosting out of town guests. First, if your property is in the city of Austin limits, you must have a permit to operate. Obtaining a Short Term Rental (STR) permit is not particularly challenging; however, you must understand the types of permits. Type 1 refers to owner-occupied residences. A Type 1 STR means that this must be the primary residence as shown in tax records. A few examples of Type 1 STRs are: you go on vacation and rent your home while you are away, you rent out 1 room in your home and stay there too, you rent out your guest house while you stay in your main house. Type 2 refers to a non-owner occupied STR that is either a single family home or a duplex, NOT a condo. A Type 2 STR is an investment property that you rent out for short term rentals. The number of Type 2 units per geographic area is limited by the City of Austin. At this time, they are not issuing any more permits for Type 2 STRs. Also, it is important to note, the STR permit does NOT convey with the sale of a property. Type 3 refers to multi-family short term rentals that are not owner occupied. The number of non-primary residence condos that can be used as STRs is also regulated by the city based on geographic regions. You must check with the city to see if your condo could be used as an STR. However, you will first want to check with your condo association to see if they allow you to rent out your condo as a STR. Similarly, many HOAs will prohibit the use of residences as STRs. If you’re thinking of purchasing a property, and would like to use it as an STR, give me a call today! I can help guide you in the right direction.

Often times my Austin clients ask me when the best time to sell a house is. This is a complex question with no one size fits all answer. The best time to sell your house depends on your needs. Some homeowners may not even have the luxury of asking when the best time to sell the house is. For example, if you are relocating for work and need to sell your house in order to purchase a new home, your options are much more limited.

That being said, there are certain times of year where home owners tend to sell for the most money. If you live in a family-oriented neighborhood with great schools, you likely want to consider selling your house in the summer which means listing your home for sale in the early spring. In Austin and elsewhere, families are often searching for homes in the spring. The home buying process from finding the right house, to getting an accepted offer, and financing can take a few months. People with children usually prefer to move in the early summer and not disrupt the kiddos during school year. If you are wondering when the best time to sell your Austin condo is, you will find vastly different patterns. I recently looked at the price fluctuations for condo sales located in downtown Austin near the University of Texas during 2016. Interestingly, I found that downtown Austin condos sold for the most amount of money in November. Alternatively, the best time to buy a condo in this area of Austin last year appeared in mid-March. I would hypothesize that these trends are similarly due to a correspondence with school calendars. Many investors and parents want to purchase these properties to rent to UT students. While you can get a great value in March, many students leave town for the summer break, and it will be more difficult to rent the condo. Another important component to consider when you are wondering if now is time to sell your house is inventory. Traditionally, at least in family-friendly Austin neighborhoods, we see more homeowners selling their properties in the spring. This is often due to one or both of the items noted earlier. The seller believes he/she will be able to sell the home for a higher amount in the spring, and/or the homeowner wants to move the family when it is convenient. Thus, often times there are less homes for sale during the non-peak selling seasons. When there simply are not any homes like yours on the market, you may want to consider selling your home. Determining the best time to sell your Austin area home requires a comprehensive understanding of the Austin area real estate market. Take a look at my video below in which my past client, Brittney explains her experience selling her Austin area home.

Take a look at my seller page if you think now may be the time to sell your Austin area home. You can learn more about the exceptional service I deliver to all my Austin clients. Alternatively, give me a call today and we can discuss your unique situation. Erika 512-779-7597.

|

BLOGSharing Austin real estate updates, home owner tips, & more. Archives

February 2024

Categories

All

|