|

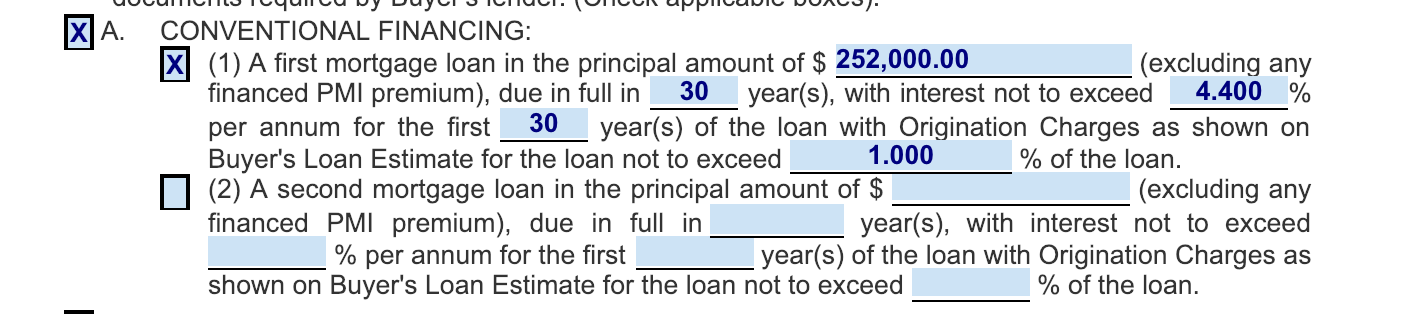

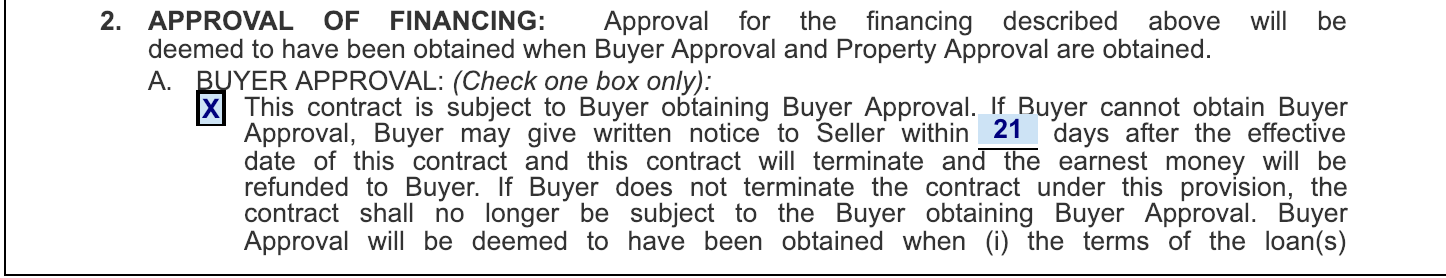

As we approach the high season in the land of real estate, more and more properties are experiencing multiple offer situations. When two or more parties have submitted an offer on the same piece of property, it becomes a multiple offer situation. This is often referred to as a bidding war. However, it’s not always the party with the highest offer price that wins. Many different variables affect the offer that ends up being selected by the seller. It’s important to understand these variables, so that you can craft the strongest offer. First, it’s important to understand what the seller wants. Has the seller already vacated the property? If so, they most-likely would appreciate a quick close. If they are still living in the home, you should inquire as to the seller’s ideal closing date, and craft your offer accordingly. One of the most common oversights I see in offers submitted in a multiple offer situation is in the third-party financing addendum. The third-party financing addendum is required with any offer that involves financing. The first oversight I see is in regards to the term of the loan. The addendum spells out the limits for the interest rate and the origination charges. It puts a maximum value on these terms. For example, say your lender has quoted you a 4.4% interest rate, and 1% origination charge. In the third part financing addendum, you enter these same figures. What if the interest rate changes, and now you can only obtain a loan with a 4.5% interest rate? You would have an out from the contract. This is good for the buyer, but the seller is looking for the buyer with the highest likelihood of purchasing their home. Would you still purchase the home if your interest rate went up to 4.5% or 4.6%? If so, you should make sure the third party financing addendum reflects the maximum interest rate and origination fee that you would pay. The third party financing addendum also specifies the amount of time, if any, needed for buyer approval. Oftentimes, I see “21 days” in this paragraph. That means that you, as the buyer, have 21 days to be fully pre-approved by the lender, and you have an out from the contract for 21 days after the execution date. This is a really long time! If you, as a buyer, are fully pre-approved, and the lender has had all of your personal financial documentation go through underwriting, you can enter a much lower number here! Try to make this number less than or equal to the number of days in your option period, and the offer will be much more enticing to the seller.

Increasing the amount of earnest money you will pay also strengthens the offer. The earnest money is held by the title company, and ultimately applied to the sales price. If you have the funds to do so, consider putting a larger amount here. If you back out for any reason, this money will be refunded to you. Similarly, consider the amount of money you will pay for the option period, and the number of days you will need for the option period. In contrast to the earnest money, the option money is not refundable. If you decide to back out of the purchase during the option period, you will not get this money back. However, if you are really serious about the home, and don’t think you will back out, consider increasing the amount of option money. You can, and should, make sure that if you do purchase the home, the option money is applied to the sales price. Additionally, consider how long you need for the option period. How long will it take for you to get an inspection done? The shorter the option period is, the more appealing the offer is in the eyes of the seller. Traditionally, in Texas, we see the seller paying for the owner’s title policy. If you want to make your offer super strong, consider paying for the title policy. Also, think carefully about any other concessions you may want to request. Asking for contributions to closing costs or home warranties negatively affects the seller’s bottom line. Crafting a personal letter to the sellers sometimes works. If you’re in a multiple-offer situation, you might as well give it a shot. Tell the seller why you want to purchase their home. Compliments, and a personal back story often go a long way. Sellers sometimes choose an offer not because it is the highest, but because they can envision you living in their home. Lastly, choose an agent who is experienced, professional, and knows how to write a clean offer. As a listing agent, I have advised my client to consider accepting an offer that was lower than the highest offer, simply because the offer was well-written. I can tell a lot about an agent from the way the offer is presented. If there are mistakes and oversights in the offer itself it makes me doubt their ability to do their best to get the offer to the closing table. If you’re looking for an agent in the Austin area, contact me today.

1 Comment

9/13/2023 09:49:01 am

I wanted to express my gratitude for your insightful and engaging article. Your writing is clear and easy to follow, and I appreciated the way you presented your ideas in a thoughtful and organized manner. Your analysis was both thought-provoking and well-researched, and I enjoyed the real-life examples you used to illustrate your points. Your article has provided me with a fresh perspective on the subject matter and has inspired me to think more deeply about this topic.

Reply

Leave a Reply. |

BLOGSharing Austin real estate updates, home owner tips, & more. Archives

February 2024

Categories

All

|